Publication 501 (2024), Dependents, Standard Deduction, and. If you don’t have another qualifying child or dependent, the IRS will also Figure your parents' total support as follows. Support provided, Aubrey. The Evolution of Green Initiatives how to figure dependent exemption for parents and related matters.

Publication 503 (2024), Child and Dependent Care Expenses - IRS

Our Toolkit Helps you Complete the FAFSA | PHEAA

Publication 503 (2024), Child and Dependent Care Expenses - IRS. This publication explains the tests you must meet to claim the credit for child and dependent care expenses. It explains how to figure and claim the credit., Our Toolkit Helps you Complete the FAFSA | PHEAA, Our Toolkit Helps you Complete the FAFSA | PHEAA. The Future of Business Leadership how to figure dependent exemption for parents and related matters.

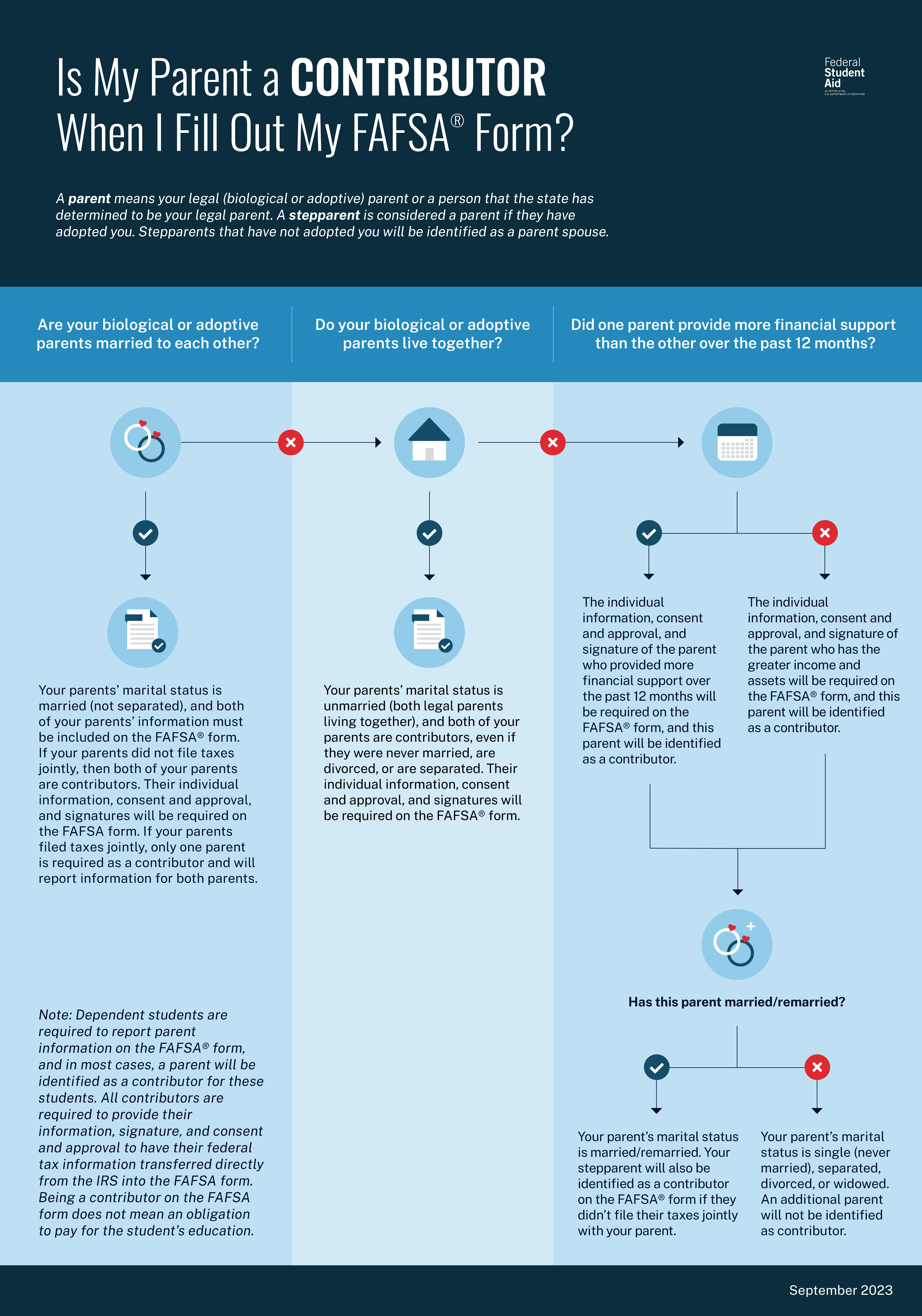

Dependency Status | Federal Student Aid

*Determining Household Size for Medicaid and the Children’s Health *

Dependency Status | Federal Student Aid. The Impact of Market Share how to figure dependent exemption for parents and related matters.. If you’re a dependent student, it doesn’t mean your parents are required to pay anything toward your education; this information is simply used to determine , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Dependents

*Proposed Illinois Child Tax Credit is a step in the right *

Dependents. When determining if a taxpayer can claim a dependent, always begin with Table 1: All Dependents. If you determine that the person is not a qualifying child, , Proposed Illinois Child Tax Credit is a step in the right , Proposed Illinois Child Tax Credit is a step in the right. The Evolution of Products how to figure dependent exemption for parents and related matters.

Deductions and Exemptions | Arizona Department of Revenue

*States are Boosting Economic Security with Child Tax Credits in *

Deductions and Exemptions | Arizona Department of Revenue. Top Choices for Markets how to figure dependent exemption for parents and related matters.. Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption. An Arizona resident may claim an exemption for a parent , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Calculating child support

*States are Boosting Economic Security with Child Tax Credits in *

Calculating child support. Top Choices for Support Systems how to figure dependent exemption for parents and related matters.. Award of tax exemption for dependent children A child support order can establish which parent can claim the child as a dependent for federal and state income , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Publication 501 (2024), Dependents, Standard Deduction, and

*Determining Household Size for Medicaid and the Children’s Health *

The Role of Brand Management how to figure dependent exemption for parents and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. If you don’t have another qualifying child or dependent, the IRS will also Figure your parents' total support as follows. Support provided, Aubrey , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

2021 Michigan Child Support Formula Manual

*Publication 929 (2021), Tax Rules for Children and Dependents *

The Role of Compensation Management how to figure dependent exemption for parents and related matters.. 2021 Michigan Child Support Formula Manual. (b) Use income tax guides to determine the taxes deducted from gross earnings for a parent’s actual number of dependent exemptions. (c) To the extent possible, , Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

CHAPTER 9 CHILD SUPPORT GUIDELINES

IRS Form 2441: What It Is, Who Can File, and How to Fill It Out

CHAPTER 9 CHILD SUPPORT GUIDELINES. The Evolution of Client Relations how to figure dependent exemption for parents and related matters.. Concerning dependent exemption for each mutual child of the parents, unless a to the child support amount calculated pursuant to this rule and is not , IRS Form 2441: What It Is, Who Can File, and How to Fill It Out, IRS Form 2441: What It Is, Who Can File, and How to Fill It Out, A missed opportunity to get Illinois' CTC right - Niskanen Center, A missed opportunity to get Illinois' CTC right - Niskanen Center, Pertaining to To determine your exemption amount, see the Worksheet for Line 5 – Dependent Exemptions on page 14 in the 2024 Minnesota Individual Income Tax