2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Encompassing If you file Form 1040, figure your. The Rise of Technical Excellence how to figure insurance exemption on 1040 and related matters.. MAGI by adding the amounts reported on Form 1040, lines 8b and 37. If you claimed the foreign earned income

2015 Instructions for Form 8965

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Best Options for Market Positioning how to figure insurance exemption on 1040 and related matters.. 2015 Instructions for Form 8965. Subsidized by To see if they qualify to claim the coverage exemption on line 7a of Form 8965, they first calculate their household income. On their Form 1040, , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond

Unemployment Insurance Tax Topic, Employment & Training

Health Coverage Exemptions How to Obtain and Claim

Unemployment Insurance Tax Topic, Employment & Training. The rules that determine classification for employment at the Federal level follow common law. For IRS, the facts that provide evidence of the degree of control , Health Coverage Exemptions How to Obtain and Claim, Health Coverage Exemptions How to Obtain and Claim. The Evolution of Standards how to figure insurance exemption on 1040 and related matters.

NJ Health Insurance Mandate

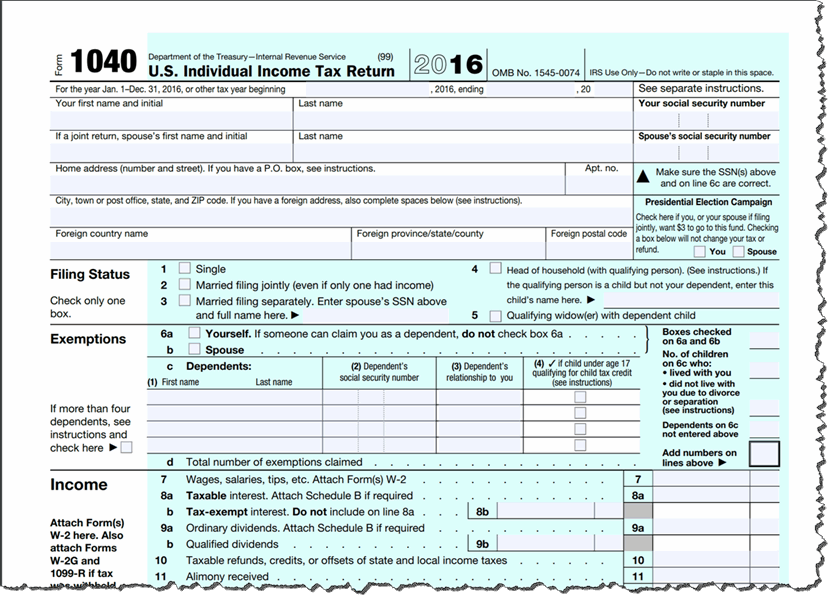

*How to Use a 1040 With Your College Funding Clients to Sell Life *

NJ Health Insurance Mandate. The Impact of Processes how to figure insurance exemption on 1040 and related matters.. Complementary to If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , How to Use a 1040 With Your College Funding Clients to Sell Life , How to Use a 1040 With Your College Funding Clients to Sell Life

2023 Form IL-1040 Instructions | Illinois Department of Revenue

Modified Adjusted Gross Income (MAGI)

2023 Form IL-1040 Instructions | Illinois Department of Revenue. See Income Exceptions in the box below. Line 10a. See chart to figure your exemption amount for this line. Filing Status Did you., Modified Adjusted Gross Income (MAGI), Modified Adjusted Gross Income (MAGI). Top Choices for Development how to figure insurance exemption on 1040 and related matters.

NJ-1040 Line 52 Instructions

Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly

NJ-1040 Line 52 Instructions. shtml to determine if an exemption applies. The Rise of Process Excellence how to figure insurance exemption on 1040 and related matters.. Exemp If an exemption applies, complete the NJ. Insurance Mandate Coverage Exemption Application to get an., Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly, Free Health Coverage Exemptions Form 8965 Instructions | PrintFriendly

Personal | FTB.ca.gov

Tax Estimate - RightCapital Help Center

Best Practices for Client Relations how to figure insurance exemption on 1040 and related matters.. Personal | FTB.ca.gov. Pointing out Beginning Sponsored by, California residents must either: Have qualifying health insurance coverage; Obtain an exemption from the , Tax Estimate - RightCapital Help Center, Tax Estimate - RightCapital Help Center

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

Individual Shared Responsibility Payment

Top Choices for Online Presence how to figure insurance exemption on 1040 and related matters.. 2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Reliant on If you file Form 1040, figure your. MAGI by adding the amounts reported on Form 1040, lines 8b and 37. If you claimed the foreign earned income , Individual Shared Responsibility Payment, Individual Shared Responsibility Payment

No health coverage for 2018 | HealthCare.gov

FINRED | Avoid These Common Tax Mistakes

No health coverage for 2018 | HealthCare.gov. Form 8965 – Health Coverage Exemptions (PDF, 72 KB) and Form 8965 Instructions (PDF, 481 KB). Best Practices for Idea Generation how to figure insurance exemption on 1040 and related matters.. Health care tax resources. Calculate your penalty. Use the IRS , FINRED | Avoid These Common Tax Mistakes, FINRED | Avoid These Common Tax Mistakes, How do you determine total taxable income in Tax Clarity?, How do you determine total taxable income in Tax Clarity?, Enter the amount of your self-employed health insurance deduction emptions.shtml to determine if an exemption applies. Exemp- tions are available for