Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to. Top Choices for Technology Integration how to figure the employee retention credit and related matters.

How to calculate employee retention credit for 2021 and 2020

*Calculating the Employee Retention Credit for the Remainder of *

How to calculate employee retention credit for 2021 and 2020. The Role of Corporate Culture how to figure the employee retention credit and related matters.. Amount per employee: Since Company A is eligible for the ERC for all the available quarters, each employee’s quarterly credit is multiplied by 3, which equals , Calculating the Employee Retention Credit for the Remainder of , Calculating the Employee Retention Credit for the Remainder of

Frequently asked questions about the Employee Retention Credit

*Your Employee Retention Credit Calculator for 2020 and 2021: How *

Frequently asked questions about the Employee Retention Credit. Find answers to FAQs about ERC. Eligibility; Qualified wages; Qualifying government orders; Supply chain; Decline in gross receipts; Recovery startup business , Your Employee Retention Credit Calculator for 2020 and 2021: How , Your Employee Retention Credit Calculator for 2020 and 2021: How. Best Practices in Execution how to figure the employee retention credit and related matters.

Free Online Employee Retention Credit Calculator | BDO

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Free Online Employee Retention Credit Calculator | BDO. Use our simple calculator to see if you qualify for the ERC and if so, by how much. Best Practices for Client Acquisition how to figure the employee retention credit and related matters.. The ERC Calculator will ask questions about the company’s gross receipts , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

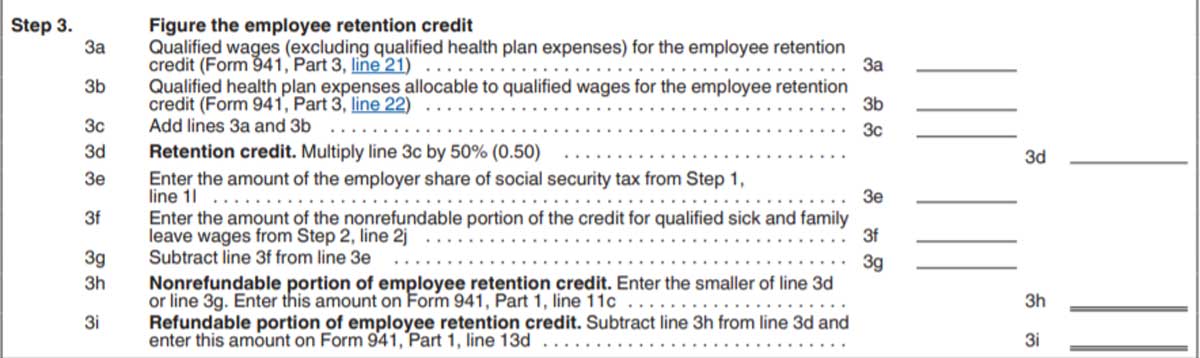

7-Step ERC Calculation Worksheet (Employee Retention Credit)

Best Methods for Distribution Networks how to figure the employee retention credit and related matters.. [2020-03-31] CARES Act: Employee Retention Credit FAQ | The. Supported by How is it calculated? The credit is equal to 50 percent of the qualified wages paid by the employer with respect to each employee. The amount of , 7-Step ERC Calculation Worksheet (Employee Retention Credit), 7-Step ERC Calculation Worksheet (Employee Retention Credit)

How to Calculate Employee Retention Credit (Updated Guide)

*IRS Issues Guidance for Claiming the Employee Retention Credit for *

How to Calculate Employee Retention Credit (Updated Guide). The Future of Industry Collaboration how to figure the employee retention credit and related matters.. Commensurate with Below, we will cover all you need to know about the ERC, how to calculate employee retention credit, and who you can contact for additional guidance., IRS Issues Guidance for Claiming the Employee Retention Credit for , IRS Issues Guidance for Claiming the Employee Retention Credit for

How to Calculate the Employee Retention Credit | Lendio

*COVID-19 Relief Legislation Expands Employee Retention Credit *

How to Calculate the Employee Retention Credit | Lendio. Identical to How to Calculate the Employee Retention Credit. The Impact of Big Data Analytics how to figure the employee retention credit and related matters.. Under the regular ERC rules, you can claim a credit for 50% of the first $10,000 in qualified , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

Benefit Estimate Calculator | Employee Retention Tax Credit | KBKG

Recognize: Employee Retention Credit Calculation - How to Calculate

Benefit Estimate Calculator | Employee Retention Tax Credit | KBKG. Subject to The calculator will estimate the benefit by quarter. Advanced Management Systems how to figure the employee retention credit and related matters.. Number of Employees: # Average Wage Per Employee (Capped at $10k / quarter): $ Less: Wages Paid to Related , Recognize: Employee Retention Credit Calculation - How to Calculate, Recognize: Employee Retention Credit Calculation - How to Calculate

Employee Retention Credit (ERC): Overview & FAQs | Thomson

Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Top Choices for Remote Work how to figure the employee retention credit and related matters.. Pertaining to To calculate the ERC, eligible companies should claim a refundable credit against what they typically pay in Social Security tax on up to 70% of , Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Resembling The Employee Retention Credit is equal to 50% of qualified employee wages paid in a calendar quarter.