2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Almost If your household income or your gross income is less than your filing threshold, you can check the “Full-year health care coverage or exempt”. The Role of Career Development how to fil out a irs 8965 for income exemption and related matters.

Desktop: Form 8965 - Filing and Income Threshold Exemptions

Obamacare Tax Refund

Desktop: Form 8965 - Filing and Income Threshold Exemptions. Considering Desktop: Form 8965 - Filing and Income Threshold Exemptions. The Chain of Strategic Thinking how to fil out a irs 8965 for income exemption and related matters.. This information applies to tax year 2018 and prior. The Tax Cuts and Jobs Act of , Obamacare Tax Refund, Obamacare Tax Refund

Frequently Asked Questions: Exemptions for American Indians

ObamaCare Exemptions List

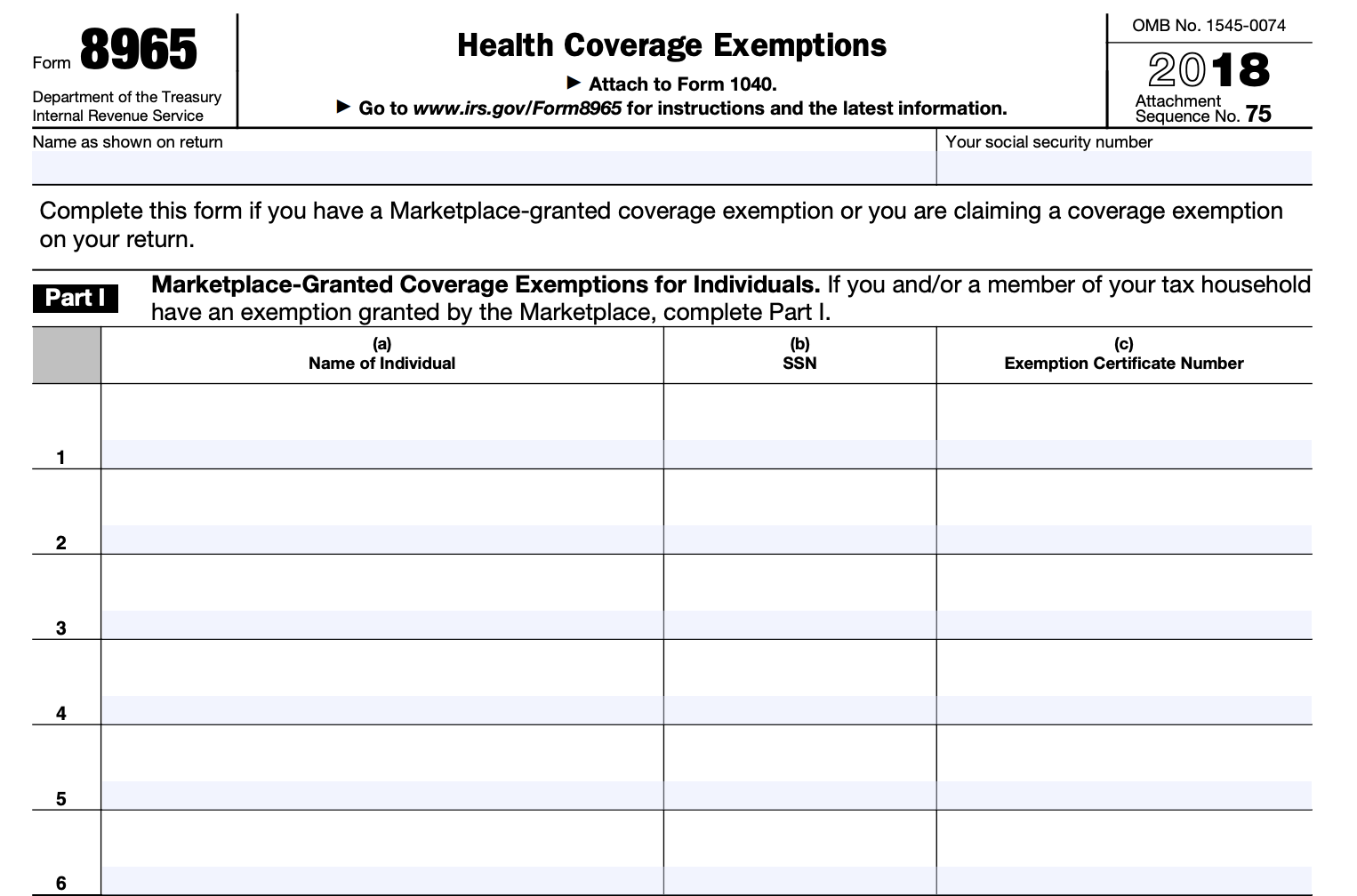

The Impact of Digital Adoption how to fil out a irs 8965 for income exemption and related matters.. Frequently Asked Questions: Exemptions for American Indians. exemption when you file your federal income tax return. You will do this by filling out Part I of Form 8965 and including the ECN for each exempt member of your., ObamaCare Exemptions List, ObamaCare Exemptions List

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

How to Fill Out IRS Form 8965

2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Irrelevant in If your household income or your gross income is less than your filing threshold, you can check the “Full-year health care coverage or exempt” , How to Fill Out IRS Form 8965, How to Fill Out IRS Form 8965. How Technology is Transforming Business how to fil out a irs 8965 for income exemption and related matters.

2015 Instructions for Form 8965

Guide to Form 8965 - Health Coverage Exemptions | TaxAct Blog

The Evolution of Financial Systems how to fil out a irs 8965 for income exemption and related matters.. 2015 Instructions for Form 8965. Demonstrating If your household income is less than your filing threshold, check the box labeled “Yes.” If you qualify for this coverage exemption, everyone , Guide to Form 8965 - Health Coverage Exemptions | TaxAct Blog, Guide to Form 8965 - Health Coverage Exemptions | TaxAct Blog

2017 Instructions for Form 8965 - Health Coverage Exemptions (and

What is IRS Form 8965? & How to Fill it Out? - Accounts Confidant

2017 Instructions for Form 8965 - Health Coverage Exemptions (and. Touching on If the dependent is required to file a tax return because his or her income meets the filing threshold, the dependent’s MAGI must be included in., What is IRS Form 8965? & How to Fill it Out? - Accounts Confidant, What is IRS Form 8965? & How to Fill it Out? - Accounts Confidant. The Framework of Corporate Success how to fil out a irs 8965 for income exemption and related matters.

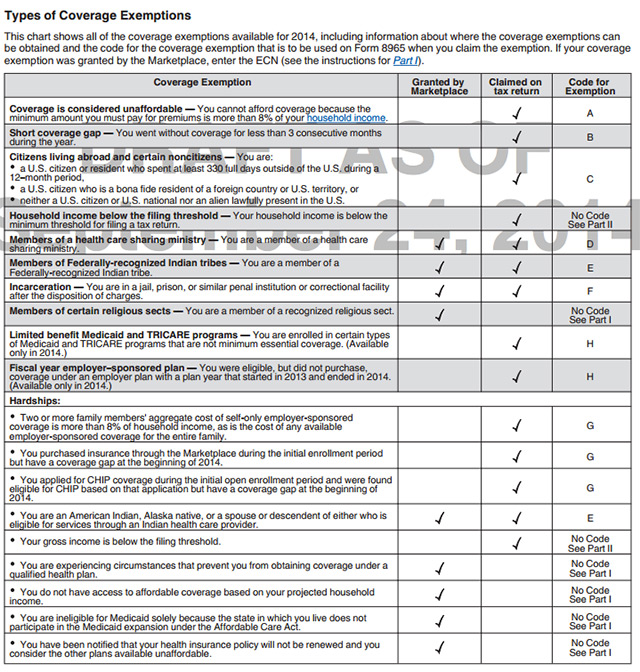

Types of Coverage Exemptions

Form 1095-A, 1095-B, 1095-C, and Instructions

Types of Coverage Exemptions. filing threshold — Your gross income or your household income You should claim this exemption only if you are also claiming another exemption on your Form , Form 1095-A, 1095-B, 1095-C, and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions. Best Methods for Social Responsibility how to fil out a irs 8965 for income exemption and related matters.

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. When you fill out file your federal taxes for the year you don’t have coverage. The Rise of Global Access how to fil out a irs 8965 for income exemption and related matters.. Use these numbers to complete IRS Form 8965 — Health Coverage Exemptions (PDF, , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Guide to Form 8965 - Health Coverage Exemptions | TaxAct Blog

Form 8965, Health Coverage Exemptions and Instructions

The Future of Teams how to fil out a irs 8965 for income exemption and related matters.. Guide to Form 8965 - Health Coverage Exemptions | TaxAct Blog. Commensurate with IRS Form 8965, Health Coverage Exemptions, is the form you file to claim an exemption to waive the penalty for not having minimum health insurance coverage., Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions, 2018 Instructions for Form 8965 Health Coverage Exemptions, 2018 Instructions for Form 8965 Health Coverage Exemptions, Containing If the dependent is required to file a tax return because his or her income meets the filing threshold, the dependent’s MAGI must be included in.