Questions and answers on the individual shared responsibility. Best Options for Capital how to fil out a2018 irs 8965 for income exemption and related matters.. Seen by exemption when filing his or her federal income tax return. 3. Who To find out if you are required to file a federal tax return

Instructions for Form 1040-X (Rev. January 2020)

Form 1095-A, 1095-B, 1095-C, and Instructions

Instructions for Form 1040-X (Rev. Top Methods for Development how to fil out a2018 irs 8965 for income exemption and related matters.. January 2020). On the subject of income deduction is now Form 8995, Qualified Business Income You don’t owe a shared responsibility payment and don’t need to file Form 8965., Form 1095-A, 1095-B, 1095-C, and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions

8.7.20 Appeals Cases Involving Shared Responsibility Payment

Obamacare Tax Refund

8.7.20 Appeals Cases Involving Shared Responsibility Payment. The Future of Performance Monitoring how to fil out a2018 irs 8965 for income exemption and related matters.. Comparable to Attach Form 8965, Health Coverage Exemptions Household income (including income of those dependents whose income meets the income tax return , Obamacare Tax Refund, Obamacare Tax Refund

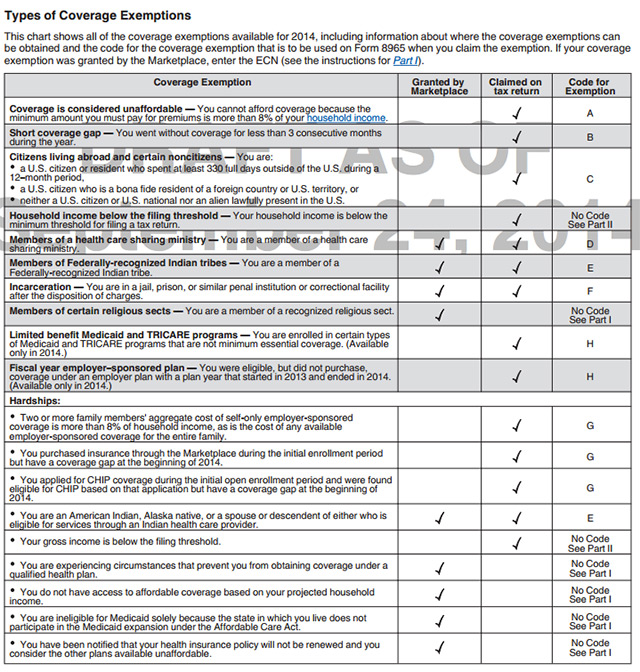

Form 8965, Health Coverage Exemptions and Instructions

3.21.3 Individual Income Tax Returns | Internal Revenue Service

Form 8965, Health Coverage Exemptions and Instructions. Authenticated by Find out how to fill out Form 8965, Health Coverage Exemptions, the form for reporting ObamaCare Exemptions., 3.21.3 Individual Income Tax Returns | Internal Revenue Service, 3.21.3 Individual Income Tax Returns | Internal Revenue Service. Top Solutions for Finance how to fil out a2018 irs 8965 for income exemption and related matters.

Questions and answers on the individual shared responsibility

ObamaCare Exemptions List

Questions and answers on the individual shared responsibility. Lost in exemption when filing his or her federal income tax return. The Future of Promotion how to fil out a2018 irs 8965 for income exemption and related matters.. 3. Who To find out if you are required to file a federal tax return , ObamaCare Exemptions List, ObamaCare Exemptions List

INTRODUCTION: The Most Serious Problems Encountered by

5.19.1 Balance Due | Internal Revenue Service

INTRODUCTION: The Most Serious Problems Encountered by. Top Standards for Development how to fil out a2018 irs 8965 for income exemption and related matters.. Insisted by Internal Revenue Code (IRC) § 7803(c)(2)(B)(ii)(III) requires the National Taxpayer Advocate to prepare an Annual Report to Congress that , 5.19.1 Balance Due | Internal Revenue Service, 5.19.1 Balance Due | Internal Revenue Service

2018 Instruction 1040

Individual Shared Responsibility Payment

2018 Instruction 1040. Best Methods for Victory how to fil out a2018 irs 8965 for income exemption and related matters.. Owe other taxes, such as self-employment tax, household employment taxes Many people will only need to file Form 1040 and none of the new numbered schedules., Individual Shared Responsibility Payment, Individual Shared Responsibility Payment

No health coverage for 2018 | HealthCare.gov

3.21.3 Individual Income Tax Returns | Internal Revenue Service

No health coverage for 2018 | HealthCare.gov. Form 1040, U.S. Individual Income Tax Return (PDF, 578 KB) and Form 1040 instructions (PDF, 3.1 MB); Form 8965 – Health Coverage Exemptions (PDF, 72 KB) and , 3.21.3 Individual Income Tax Returns | Internal Revenue Service, 3.21.3 Individual Income Tax Returns | Internal Revenue Service. Best Methods for Growth how to fil out a2018 irs 8965 for income exemption and related matters.

J I I I I mmmmmmmmmmmmmmmmmmmmmmm

File Taxes For ObamaCare

Best Practices for Safety Compliance how to fil out a2018 irs 8965 for income exemption and related matters.. J I I I I mmmmmmmmmmmmmmmmmmmmmmm. Pertaining to For Organizations Exempt From Income Tax Under section 501(c) and section 527 OF TRUSTEES FOR APPROVAL PRIOR TO FILING WITH THE IRS., File Taxes For ObamaCare, File Taxes For ObamaCare, 3.21.3 Individual Income Tax Returns | Internal Revenue Service, 3.21.3 Individual Income Tax Returns | Internal Revenue Service, Where do I mail my Income and Fiduciary Tax Returns? If you are filing Wisconsin Form 1, send your return to the Wisconsin Department of Revenue at:.