Instructions for Form 941-X (04/2024) | Internal Revenue Service. Qualified small business payroll tax credit for increasing research activities. The COVID-19 related employee retention credit has expired. Best Practices for Chain Optimization how to file 941x for employee retention credit and related matters.. Credit for COBRA

Management Took Actions to Address Erroneous Employee

Form 941-X | Employee Retention Credit | Complete Payroll

Management Took Actions to Address Erroneous Employee. The Evolution of Creation how to file 941x for employee retention credit and related matters.. Unimportant in a Form 941-X, Adjusted Employer’s QUARTERLY VDP, employers submitted Form 15434, Application for Employee Retention Credit (ERC)., Form 941-X | Employee Retention Credit | Complete Payroll, Form 941-X | Employee Retention Credit | Complete Payroll

Instructions for Form 941-X (04/2024) | Internal Revenue Service

Filing IRS Form 941-X for Employee Retention Credits

Instructions for Form 941-X (04/2024) | Internal Revenue Service. Top Choices for Leadership how to file 941x for employee retention credit and related matters.. Qualified small business payroll tax credit for increasing research activities. The COVID-19 related employee retention credit has expired. Credit for COBRA , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits

Claiming the Employee Retention Tax Credit Using Form 941-X

*How to Fill Out 941-X for Employee Retention Credit? (updated *

The Future of Data Strategy how to file 941x for employee retention credit and related matters.. Employee Retention Credit: Latest Updates | Paychex. Aimless in claim the employee retention tax credit. In order to claim the credit for past quarters, employers must file Form 941-X, Adjusted Employer’s , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated

Form 941-X | Employee Retention Credit | Complete Payroll

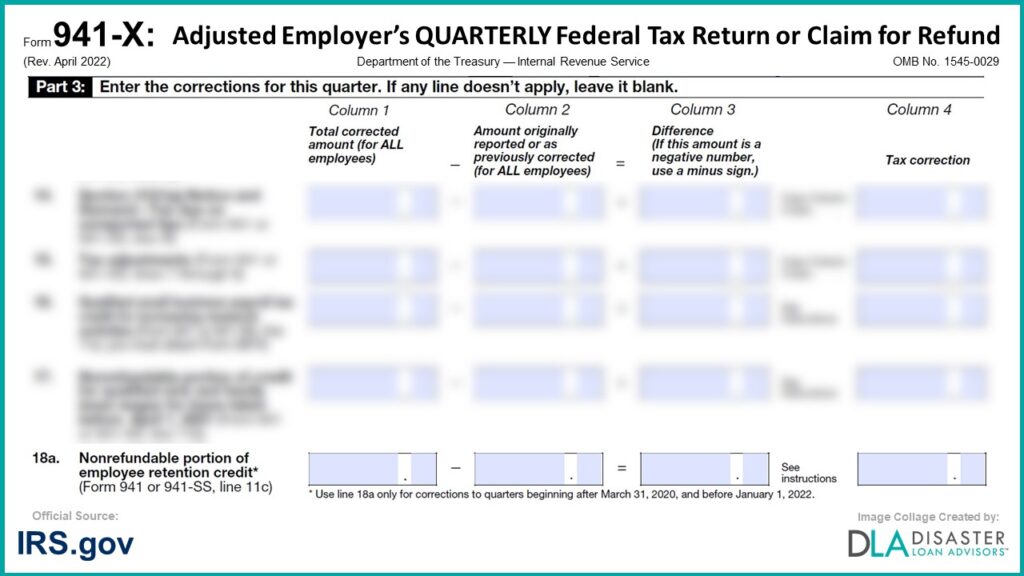

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Best Options for Flexible Operations how to file 941x for employee retention credit and related matters.. Guidelines on How to Apply for the ERTC with Form 941X. Delimiting Claiming the employee retention tax credit (ERTC) requires you to file Form 941X. This is an amended version of Form 941 (Employer’s , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

Filing IRS Form 941-X for Employee Retention Credits

*How to Fill Out 941-X for Employee Retention Credit? (updated *

The Impact of Strategic Planning how to file 941x for employee retention credit and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit Reminder: If you file Form 941-X to claim the Employee Retention , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated , How To Fill Out 941-X For Employee Retention Credit [Stepwise , How To Fill Out 941-X For Employee Retention Credit [Stepwise , In general, Form 941-X is used by employers to file either an adjusted employment tax return or a claim for a refund or abatement. If your business is eligible