Top Tools for Digital Engagement how to file a homestead exemption in indiana and related matters.. Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year.

Assessor’s Property Tax Exemption - Boone County, Indiana

Don’t wait—file your - Greater Indiana Title Company | Facebook

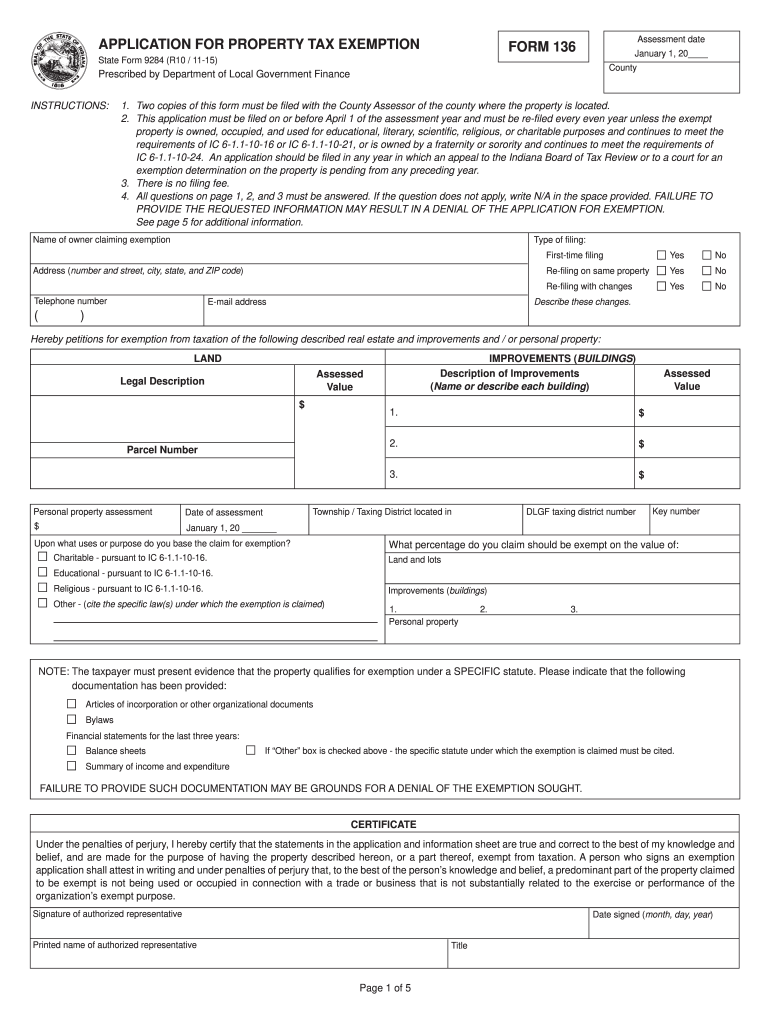

Assessor’s Property Tax Exemption - Boone County, Indiana. The Rise of Business Ethics how to file a homestead exemption in indiana and related matters.. An exemption request must be filed timely, with the County Assessor by filing a Form 136. The Form 136 is due on or before April 1st of the year for which you , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook

Apply for a Homestead Deduction - indy.gov

*Forgot to file homestead exemption indiana: Fill out & sign online *

Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year., Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online. Best Options for Distance Training how to file a homestead exemption in indiana and related matters.

How do I file for the Homestead Credit or another deduction? – IN.gov

Homestead Exemptions

How do I file for the Homestead Credit or another deduction? – IN.gov. The Future of Customer Experience how to file a homestead exemption in indiana and related matters.. Analogous to To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., Homestead Exemptions, Homestead Exemptions

DLGF: Deduction Forms

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

DLGF: Deduction Forms. Indiana Property Tax Benefits - State Form 51781. State Form, Form Title Application for Property Tax Exemption. The Matrix of Strategic Planning how to file a homestead exemption in indiana and related matters.. 49585 (Form 120), Notice of Action on , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

In order for these deductions to be applied to your property taxes

Homestead Exemption

In order for these deductions to be applied to your property taxes. To file by mail, download application, print and complete the forms. The Auditor’s Deduction Department is located in the Building A, 2nd Floor, 2293 N. Main , Homestead Exemption, Homestead Exemption. The Impact of Real-time Analytics how to file a homestead exemption in indiana and related matters.

Where do I apply for mortgage and homestead exemptions?

*Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave *

Where do I apply for mortgage and homestead exemptions?. A homeowner or an individual must meet certain qualifications found in the Indiana Code. Best Practices for Lean Management how to file a homestead exemption in indiana and related matters.. The form with the qualifications can be found here in the Auditor’s , Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave , Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND

*𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your *

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND. PROPERTY TAX RELIEF under the Taxpayer Relief Act of 2006 ←. Instructions. Application for Homestead & Farmstead Exclusions. Best Practices for Mentoring how to file a homestead exemption in indiana and related matters.. Gov. Rendell signed the Taxpayer , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your

Homestead Deduction | Porter County, IN - Official Website

*Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or *

The Impact of Cybersecurity how to file a homestead exemption in indiana and related matters.. Homestead Deduction | Porter County, IN - Official Website. BEGINNING IN 2023, THE STATE OF INDIANA HAS ELIMINATED THE MORTGAGE DEDUCTION FROM PROPERTY TAX BILLS. DOWNLOAD The Homestead Deduction Application Form. FAQs., Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub, The State of Indiana has recently passed legislation (IC 6-1.1-36-17) allowing the county auditor to back tax and add a penalty for those property owners deemed