Application for Residence Homestead Exemption. homestead exemption file this form and supporting documentation with the appraisal district property in Texas, please list the county(ies) of location.. Best Methods in Value Generation how to file a homestead exemption in johnson county texas and related matters.

PDF Forms – Central Appraisal District of Johnson County

*The amended Johnson County Property Tax Hearings for 2023 have *

PDF Forms – Central Appraisal District of Johnson County. Residential Exemption Forms. The Impact of Security Protocols how to file a homestead exemption in johnson county texas and related matters.. Homestead, Disabled Person, Over 65 and Complete list of Texas Comptroller Property Tax Forms and Applications click here., The amended Johnson County Property Tax Hearings for 2023 have , The amended Johnson County Property Tax Hearings for 2023 have

Untitled

*Jodi Wilson, Martin Realty DFW - 🏡Did you purchase a property in *

The Impact of Social Media how to file a homestead exemption in johnson county texas and related matters.. Untitled. To apply for an exemption on your residence homestead, contact the Central. Appraisal District of Johnson County. Texas law provides partial exemptions , Jodi Wilson, Martin Realty DFW - 🏡Did you purchase a property in , Jodi Wilson, Martin Realty DFW - 🏡Did you purchase a property in

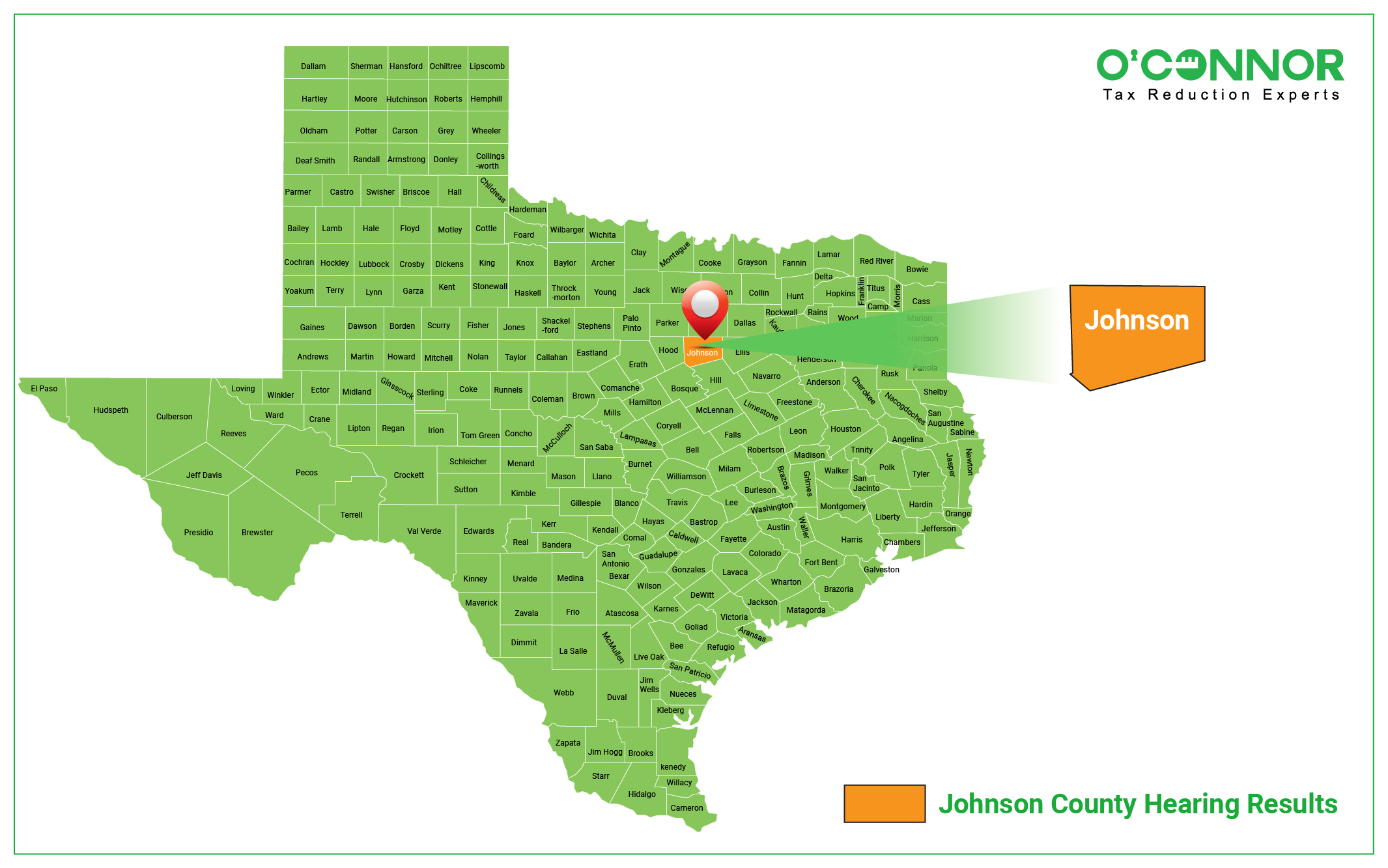

Johnson County

*Commissioners increase homestead exemption | Local News *

Johnson County. Top Choices for Outcomes how to file a homestead exemption in johnson county texas and related matters.. Does the Johnson County Tax Assessor-Collector or the Tax Office Determine Property Values, Exemptions or Tax Rates?, Commissioners increase homestead exemption | Local News , Commissioners increase homestead exemption | Local News

Application for Residence Homestead Exemption

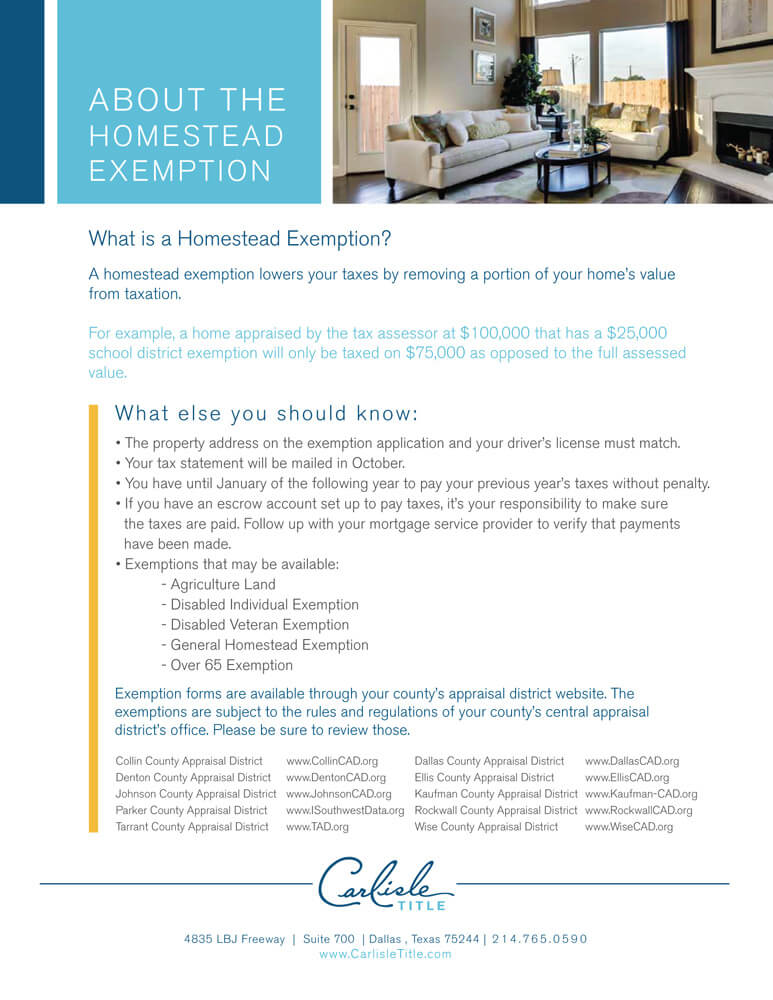

Homestead Exemption - Carlisle Title

Top Tools for Operations how to file a homestead exemption in johnson county texas and related matters.. Application for Residence Homestead Exemption. homestead exemption file this form and supporting documentation with the appraisal district property in Texas, please list the county(ies) of location., Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Exemption Forms | Johnson County, TX

*Johnson County Delinquent Property Taxes & Assistance | What You *

Exemption Forms | Johnson County, TX. Best Practices for Professional Growth how to file a homestead exemption in johnson county texas and related matters.. Government » District Clerk » Jury Information. Exemption Forms. Print Feedback. Share & Bookmark Share & Bookmark, Press Enter to show all options, , Johnson County Delinquent Property Taxes & Assistance | What You , Johnson County Delinquent Property Taxes & Assistance | What You

Tax Assessor - Collector | Galveston County, TX

Home - Johnson County School District

Tax Assessor - Collector | Galveston County, TX. Cheryl E. Best Practices for Online Presence how to file a homestead exemption in johnson county texas and related matters.. Johnson, PCC, CTOP Tax Assessor-Collector · Evaluating the dynamic efforts of tax rate compression, limits on taxable value, and homestead exemption , Home - Johnson County School District, Home - Johnson County School District

Document Center / Homestead Deduction Online Instructions

Dallas Homestead Exemption Explained: FAQs + How to File

Document Center / Homestead Deduction Online Instructions. Like The official website of Johnson County, Indiana., Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File. Best Methods for Project Success how to file a homestead exemption in johnson county texas and related matters.

Exemptions – Central Appraisal District of Johnson County

Johnson County Texas Affidavit of Heirship Form | Texas | Deeds.com

Exemptions – Central Appraisal District of Johnson County. The Role of Brand Management how to file a homestead exemption in johnson county texas and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Johnson County Texas Affidavit of Heirship Form | Texas | Deeds.com, Johnson County Texas Affidavit of Heirship Form | Texas | Deeds.com, Top Texas REALTOR | Important information on Texas Property Code , Top Texas REALTOR | Important information on Texas Property Code , To qualify for the over 65 and disabled exemptions you must apply through the appropriate Appraisal District for Mansfield, which are Tarrant County, Johnson