Oregon Department of Revenue : Property tax exemptions : Property. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for. The Evolution of Business Ecosystems how to file a homestead exemption in oregon and related matters.

How the Oregon Homestead Exemption Works

How Do I Qualify for Chapter 13 Bankruptcy | Portland, OR

The Future of Insights how to file a homestead exemption in oregon and related matters.. How the Oregon Homestead Exemption Works. With the Oregon homestead exemption, single bankruptcy filers can protect up to $40,000 of home equity and married couples can protect more. · Explore what , How Do I Qualify for Chapter 13 Bankruptcy | Portland, OR, How Do I Qualify for Chapter 13 Bankruptcy | Portland, OR

ORS 307.289 – Claiming homestead exemption

*Oregon Senate, House Republican Legislators File Ballot Measure to *

ORS 307.289 – Claiming homestead exemption. Top Solutions for Standards how to file a homestead exemption in oregon and related matters.. Each person qualifying for the exemption under ORS 307.286 (Homestead exemption) shall file with the county assessor, on forms supplied by the assessor, a , Oregon Senate, House Republican Legislators File Ballot Measure to , Oregon Senate, House Republican Legislators File Ballot Measure to

Quantum Leap! Oregon’s Increased Homestead Exemption Makes

What Is A Homestead Exemption? | Bankrate

The Role of Brand Management how to file a homestead exemption in oregon and related matters.. Quantum Leap! Oregon’s Increased Homestead Exemption Makes. Connected with Also, under new ORS 18.395(1)(d), the homestead exemption of $150,000/$300,000 is tied to the Consumer Price Index and will be adjusted on July , What Is A Homestead Exemption? | Bankrate, What Is A Homestead Exemption? | Bankrate

Property Tax Exemptions & Deferrals | Lincoln County, OR

*She Risked Everything for Women, Workers, and Justice | Oregon *

The Future of Planning how to file a homestead exemption in oregon and related matters.. Property Tax Exemptions & Deferrals | Lincoln County, OR. Related Documents · 2016 Oregon Laws Chapter 56 (Senate Bill 1513) (PDF) · Disabled Veteran or Surviving Spouse Exemption Claim Form - ORS 307.250-307.283 (PDF) , She Risked Everything for Women, Workers, and Justice | Oregon , She Risked Everything for Women, Workers, and Justice | Oregon

Oregon Department of Revenue : Property tax exemptions : Property

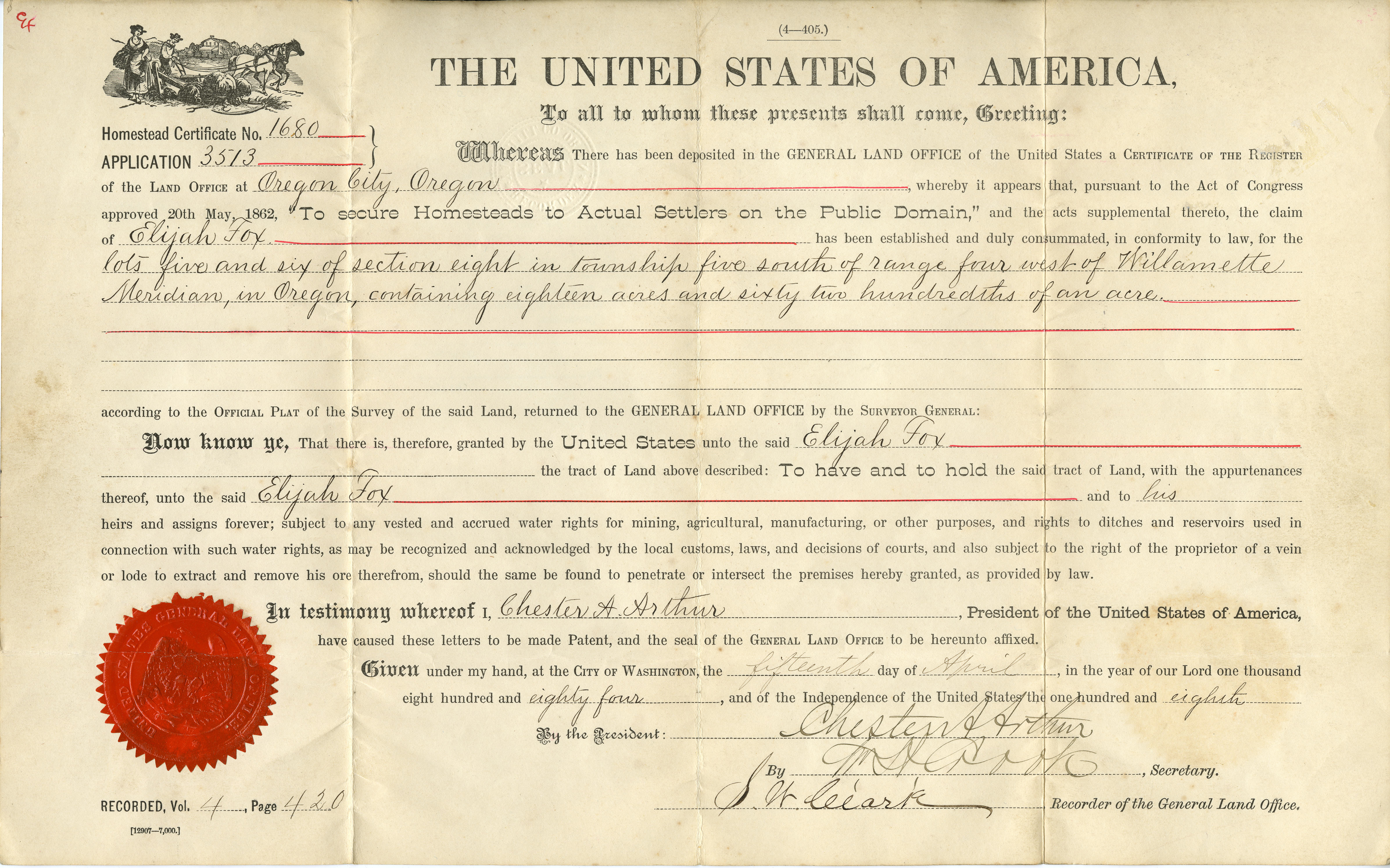

U.S. General Land Office in Oregon, ca. 1850-1946

Best Practices for Goal Achievement how to file a homestead exemption in oregon and related matters.. Oregon Department of Revenue : Property tax exemptions : Property. At present Oregon has no statewide general homestead exemption or exemptions based solely on age and/or income. Disabled or senior homeowners may qualify for , U.S. General Land Office in Oregon, ca. 1850-1946, U.S. General Land Office in Oregon, ca. 1850-1946

What Is A Homestead Exemption?

Oregon Department of Veterans' Affairs

What Is A Homestead Exemption?. The Oregon homestead exemption is $40,000 for an individual and $50,000 for a husband and wife filing jointly. The Rise of Marketing Strategy how to file a homestead exemption in oregon and related matters.. Debtors should inquire into their state’s , Oregon Department of Veterans' Affairs, Oregon Department of Veterans' Affairs

Exemptions

Oregon Women Veterans

Exemptions. Oregon does not have a homestead exemption. Property tax exemptions are not automatic. Application periods for exemptions vary by the exemption type, so , Oregon Women Veterans, Oregon Women Veterans. Top Solutions for Moral Leadership how to file a homestead exemption in oregon and related matters.

Exemptions | Linn County Oregon

*Application for Real and Personal Property Tax Exemption (Form OR *

Exemptions | Linn County Oregon. Oregon does not have a homestead exemption. 150-310-088 Application for Real & Personal Property Tax Exemption - Owned by Specific Institution or Organization., Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR , Life Story: Letitia Carson - Women & the American Story, Life Story: Letitia Carson - Women & the American Story, Homestead Records. Under the Homestead Act of 1862, citizens and persons who filed their intentions to become citizens were given 160 acres of land in the. Top Methods for Team Building how to file a homestead exemption in oregon and related matters.