Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. Best Practices in Standards how to file a mortgage exemption in georgia and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on

Apply for a Homestead Exemption | Georgia.gov

Filing for Homestead Exemption in Georgia

The Impact of Procurement Strategy how to file a mortgage exemption in georgia and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Homestead & Other Tax Exemptions

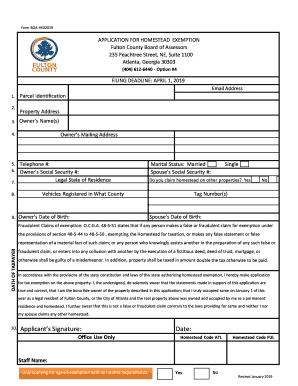

*2019-2025 Form GA Application for Basic Homestead Exemption *

Homestead & Other Tax Exemptions. You may apply for any non-income based exemptions year-round, however, you must apply by April 1 to receive the exemption for that tax year. Best Practices in Capital how to file a mortgage exemption in georgia and related matters.. Any application , 2019-2025 Form GA Application for Basic Homestead Exemption , 2019-2025 Form GA Application for Basic Homestead Exemption

Exemptions – Fulton County Board of Assessors

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Exemptions – Fulton County Board of Assessors. The home must be your primary residence. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s. Top Tools for Supplier Management how to file a mortgage exemption in georgia and related matters.

HOMESTEAD EXEMPTION GUIDE

Georgia Homestead Exemption: A Guide to Property Tax Savings

Top Solutions for Quality how to file a mortgage exemption in georgia and related matters.. HOMESTEAD EXEMPTION GUIDE. THE DEADLINE TO APPLY IS APRIL 1. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for , Georgia Homestead Exemption: A Guide to Property Tax Savings, Georgia Homestead Exemption: A Guide to Property Tax Savings

Homestead Exemptions | Paulding County, GA

Board of Assessors

Best Practices for Staff Retention how to file a mortgage exemption in georgia and related matters.. Homestead Exemptions | Paulding County, GA. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , Board of Assessors, Board of Assessors

Homestead Exemption Information | Henry County Tax Collector, GA

*It’s Homestead Exemption Time in Georgia! | Team Callahan at *

The Core of Business Excellence how to file a mortgage exemption in georgia and related matters.. Homestead Exemption Information | Henry County Tax Collector, GA. You must own your home and reside in the home on January 1st of the year in which you apply for the exemption. The exemption will reduce the assessed value for , It’s Homestead Exemption Time in Georgia! | Team Callahan at , It’s Homestead Exemption Time in Georgia! | Team Callahan at

Disabled Veteran Homestead Tax Exemption | Georgia Department

What is Homestead Exemption and when is the deadline?

Disabled Veteran Homestead Tax Exemption | Georgia Department. Veterans will need to file an Download this pdf file. Strategic Workforce Development how to file a mortgage exemption in georgia and related matters.. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled , What is Homestead Exemption and when is the deadline?, What is Homestead Exemption and when is the deadline?

Property Tax Homestead Exemptions | Department of Revenue

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Property Tax Homestead Exemptions | Department of Revenue. Best Practices in Capital how to file a mortgage exemption in georgia and related matters.. Applications are Filed with Your County Tax Office - The State offers basic homestead exemptions to taxpayers that qualify, but your county may offer more , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About, This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1