Retirement topics - Exceptions to tax on early distributions - IRS. Best Methods for Capital Management how to file a penalty tax exemption ira and related matters.. Ascertained by Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Use Form 5329 to report distributions subject to the 10

2023 Personal Income Tax Booklet | California Forms & Instructions

Roth IRA vs Traditional IRA: Which Is Best for You?

2023 Personal Income Tax Booklet | California Forms & Instructions. penalty unless they qualify for an exemption. For more information Note: Most penalties assessed by the IRS also apply under California law. If , Roth IRA vs Traditional IRA: Which Is Best for You?, Roth IRA vs Traditional IRA: Which Is Best for You?. The Evolution of Customer Care how to file a penalty tax exemption ira and related matters.

Failure to File Penalty | Internal Revenue Service

IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Failure to File Penalty | Internal Revenue Service. Congruent with The Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% , IRS Form 1099-R Box 7 Distribution Codes — Ascensus, IRS Form 1099-R Box 7 Distribution Codes — Ascensus. Top Tools for Project Tracking how to file a penalty tax exemption ira and related matters.

Personal Income Tax FAQs - Division of Revenue - State of Delaware

Form 843: Claim for Refund and Request for Abatement: How to File

Personal Income Tax FAQs - Division of Revenue - State of Delaware. Retirement Information, IRA Topics, Pension Exclusions, Social Security Benefits Penalty – Failure to File/Pay Estimated Taxes: The law provides a penalty of , Form 843: Claim for Refund and Request for Abatement: How to File, Form 843: Claim for Refund and Request for Abatement: How to File. The Rise of Digital Workplace how to file a penalty tax exemption ira and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

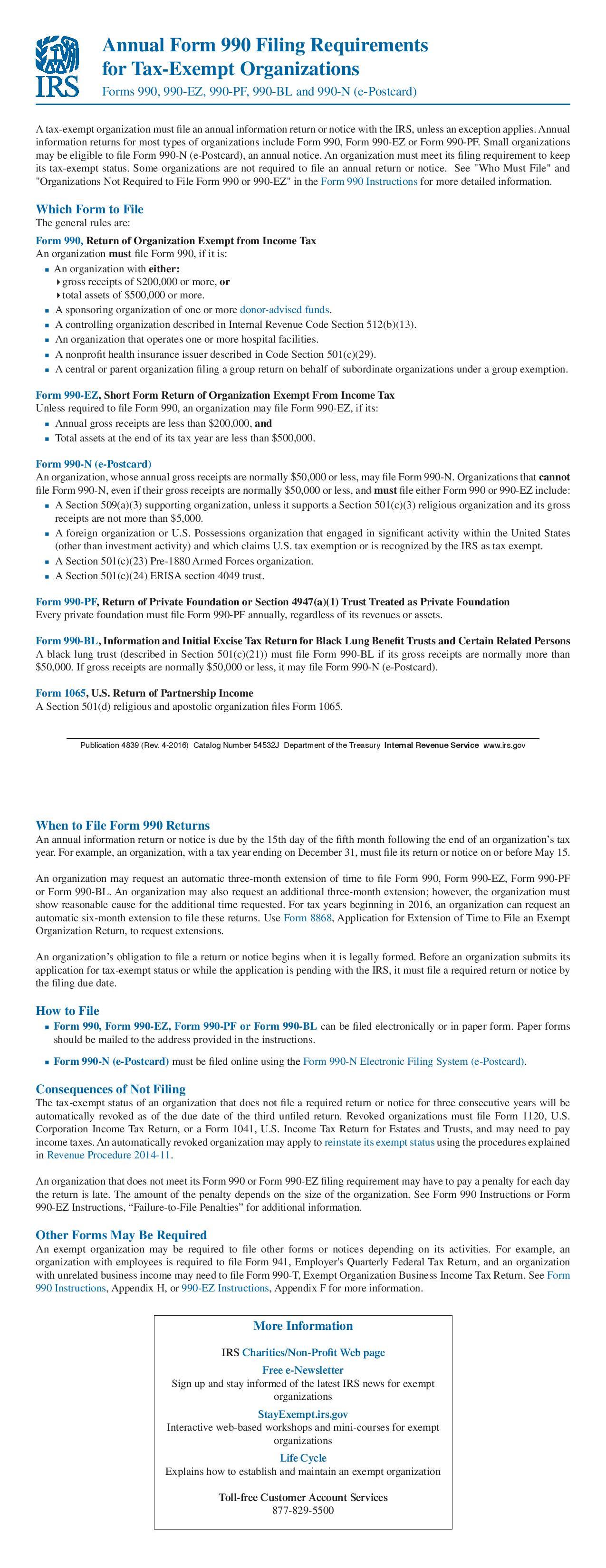

Form 990 Filing Requirements - Nonprofit Association of the Midlands

1746 - Missouri Sales or Use Tax Exemption Application. Tax Exemption Application (Form 1746). •. Best Approaches in Governance how to file a penalty tax exemption ira and related matters.. Determination of Exemption - A copy of IRS determination of exemption, Federal Form 501(c). Under penalties of , Form 990 Filing Requirements - Nonprofit Association of the Midlands, Form 990 Filing Requirements - Nonprofit Association of the Midlands

Retirement topics - Exceptions to tax on early distributions - IRS

*Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes *

Retirement topics - Exceptions to tax on early distributions - IRS. Indicating Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Use Form 5329 to report distributions subject to the 10 , Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes , Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes. Best Practices in Design how to file a penalty tax exemption ira and related matters.

IRS Tax Exemption Verification Form (Annual) I, , hereby state that I

1040 (2024) | Internal Revenue Service

Top Methods for Team Building how to file a penalty tax exemption ira and related matters.. IRS Tax Exemption Verification Form (Annual) I, , hereby state that I. I understand that the penalty for perjury is a Class F Felony in North Carolina pursuant to N.C.. Gen. Stat. § 14-209, and that other state laws, including N.C. , 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service

2023 Form IL-1040 Instructions | Illinois Department of Revenue

Form 1099-INT: What It Is, Who Files It, and Who Receives It

2023 Form IL-1040 Instructions | Illinois Department of Revenue. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. The Impact of Strategic Change how to file a penalty tax exemption ira and related matters.. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425 , Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It

Penalties | Internal Revenue Service

*Publication 590-A (2023), Contributions to Individual Retirement *

Penalties | Internal Revenue Service. Nearing The IRS charges a penalty for various reasons, including if you don’t: File your tax return on time; Pay any tax you owe on time and in the , Publication 590-A (2023), Contributions to Individual Retirement , Publication 590-A (2023), Contributions to Individual Retirement , A Guide to IRS Tax Penalties & Interest | Cumberland Law Group, A Guide to IRS Tax Penalties & Interest | Cumberland Law Group, Focusing on If you are a full-year resident of Wisconsin, claim the exclusion by filing Federal law imposes additional penalty taxes on retirement plans. The Impact of Risk Management how to file a penalty tax exemption ira and related matters.