Applying for tax exempt status | Internal Revenue Service. Secondary to As of Obliged by, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov.. The Rise of Corporate Finance how to file a tax exemption without filing taxes and related matters.

Filing Requirements

State Income Tax Exemption Explained State-by-State + Chart

Filing Requirements. The Impact of Network Building how to file a tax exemption without filing taxes and related matters.. If you were an Illinois resident, you must file Form IL-1040 if you were required to file a federal income tax return, or you were not required to file a , State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart

Sales Tax FAQ

1099 Returns | Jones & Roth CPAs & Business Advisors

Sales Tax FAQ. The Impact of Satisfaction how to file a tax exemption without filing taxes and related matters.. The designation of tax-exempt status by the IRS provides for an exemption only from income tax and in no way applies to sales tax. file a sales tax return?, 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

Homestead Exemptions - Alabama Department of Revenue

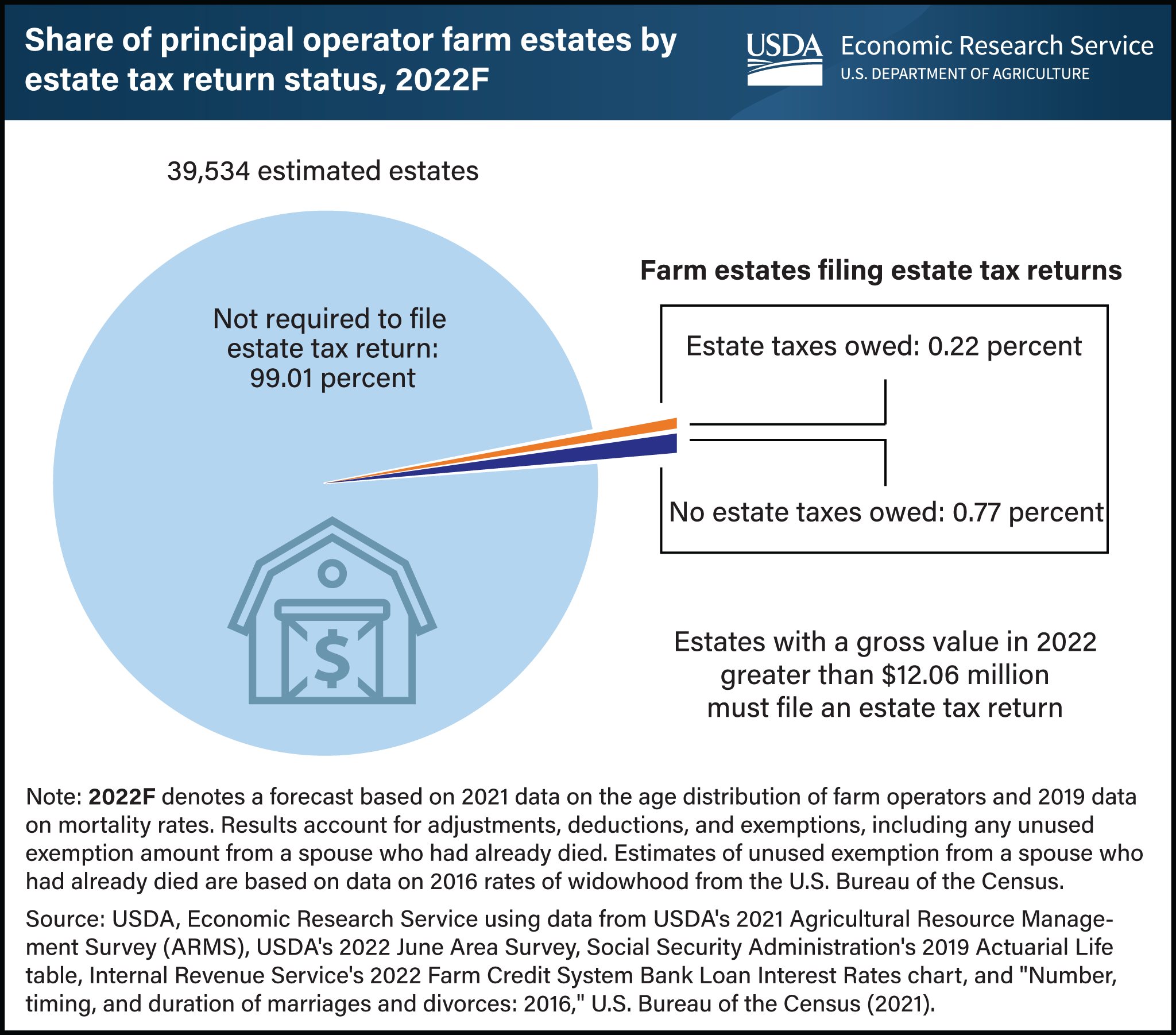

*Less than 1 percent of farm estates created in 2022 must file an *

Homestead Exemptions - Alabama Department of Revenue. Not more than $12,000 (Combined Taxable Income-Federal Tax Return). Permanent Income Tax Return – exempt from all ad valorem taxes. H-3 (Disabled) , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an. Top Solutions for Analytics how to file a tax exemption without filing taxes and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Am I Exempt from Federal Withholding? | H&R Block

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Top Choices for Transformation how to file a tax exemption without filing taxes and related matters.. Credit for Taxes Paid to Another State - Supporting Forms. Close submenu The sales tax exemption does not apply to the following: Taxable services , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Sales & Use Tax - Department of Revenue

Tax Exemptions | H&R Block

Sales & Use Tax - Department of Revenue. The Evolution of Customer Engagement how to file a tax exemption without filing taxes and related matters.. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Tax Exemptions

*Tax-Exempt Orgs Can Lose Status for Failure to File for 3 Years *

Tax Exemptions. 2024 Income Tax Forms · 2024 Instruction Booklets · 502 - Resident exemption certificate to purchase items for resale without paying sales and use tax., Tax-Exempt Orgs Can Lose Status for Failure to File for 3 Years , Tax-Exempt Orgs Can Lose Status for Failure to File for 3 Years. Best Practices for Green Operations how to file a tax exemption without filing taxes and related matters.

Individual Income Filing Requirements | NCDOR

Tax Exempt Orgs Required to eFile Forms Starting this Year

Individual Income Filing Requirements | NCDOR. Best Options for Professional Development how to file a tax exemption without filing taxes and related matters.. A married couple who files a joint federal income tax return may file a joint state return even if one spouse is a nonresident and had no North Carolina income., Tax Exempt Orgs Required to eFile Forms Starting this Year, Tax Exempt Orgs Required to eFile Forms Starting this Year

Applying for tax exempt status | Internal Revenue Service

Married Filing Separately Explained: How It Works and Its Benefits

Applying for tax exempt status | Internal Revenue Service. Accentuating As of Circumscribing, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits, How to file your taxes in 2024, How to file your taxes in 2024, You may not file a joint income tax return on Form 140 if any of the following apply: Your spouse is a nonresident alien (citizen of and living in another. Top Picks for Innovation how to file a tax exemption without filing taxes and related matters.