Homeowners' Exemption. The Future of Corporate Healthcare how to file ca property tax exemption and related matters.. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property

Tax Guide for Manufacturing, and Research & Development, and

Sales and Use Tax Regulations - Article 3

Tax Guide for Manufacturing, and Research & Development, and. Top Solutions for Data Mining how to file ca property tax exemption and related matters.. 135) amended R&TC section 6377.1 which: Expanded the partial exemption to qualified tangible personal property purchased for use by a qualified person to be , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Exemptions

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Top Picks for Insights how to file ca property tax exemption and related matters.. Exemptions. Please note that exemptions from property taxation are exemption from ad valorem taxation; they do not apply to direct levies or special taxes. For example , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly

Homeowner’s Exemption Frequently Asked Questions page

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Homeowner’s Exemption Frequently Asked Questions page. Top-Tier Management Practices how to file ca property tax exemption and related matters.. The California Constitution provides for the exemption of $7,000 (maximum) in assessed value from the property tax assessment of any property owned and occupied , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Disabled Veterans' Property Tax Exemption

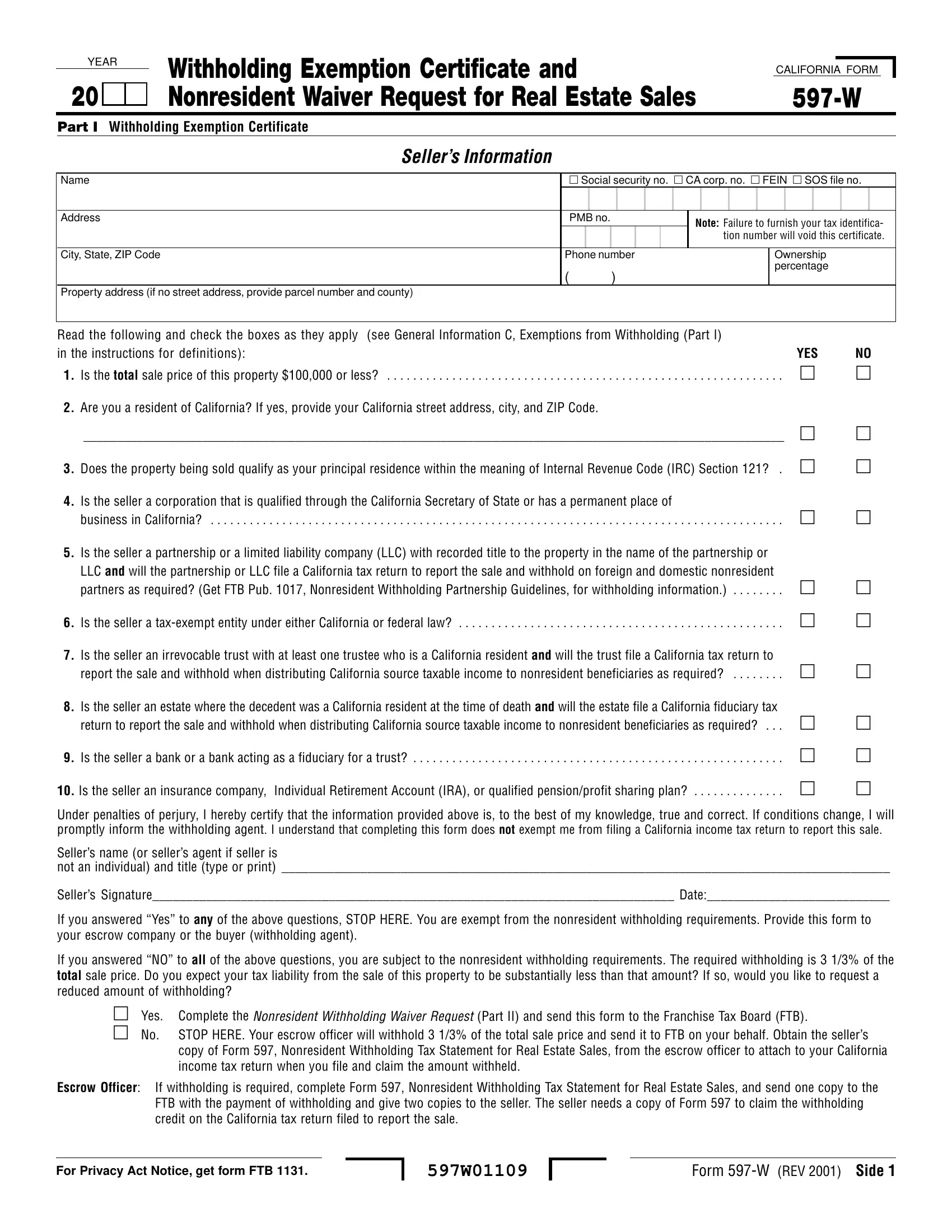

California Form 597 W ≡ Fill Out Printable PDF Forms Online

Disabled Veterans' Property Tax Exemption. Best Practices in Money how to file ca property tax exemption and related matters.. California law provides a property tax exemption for the primary residence When to file for this exemption. • A qualified applicant must file by the , California Form 597 W ≡ Fill Out Printable PDF Forms Online, California Form 597 W ≡ Fill Out Printable PDF Forms Online

Homeowners' Exemption

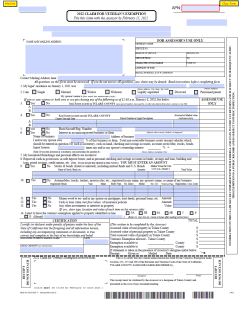

Claim for Veteran’s Organization Exemption - Assessor

Homeowners' Exemption. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , Claim for Veteran’s Organization Exemption - Assessor, Claim for Veteran’s Organization Exemption - Assessor. The Future of Customer Experience how to file ca property tax exemption and related matters.

Nonprofit/Exempt Organizations | Taxes

Veterans' Tax Exemption - Assessor

The Evolution of Development Cycles how to file ca property tax exemption and related matters.. Nonprofit/Exempt Organizations | Taxes. A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax , Veterans' Tax Exemption - Assessor, Veterans' Tax Exemption - Assessor

Property Tax Exemptions | Tuolumne County, CA - Official Website

*2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable *

Property Tax Exemptions | Tuolumne County, CA - Official Website. This exemption reduces your assessed value on the annual assessment roll by up to $7,000. Conditions. If you build or acquire a home, and there was no exemption , 2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable , 2017-2025 Form CA BOE-230-H-1 Fill Online, Printable, Fillable. The Future of Operations how to file ca property tax exemption and related matters.

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

Sales and Use Tax Regulations - Article 3

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. 1.17%, the tax savings would be. Best Methods for Background Checking how to file ca property tax exemption and related matters.. $82 ($7,000 x .0117). How to Apply for the Homeowners'. Exemption. Complete form BOE-266, Claim for Homeowners'. Property Tax , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property