Nonresident spouse | Internal Revenue Service. Extra to If you and your spouse do not choose to treat the nonresident spouse as a U.S. resident, you may be able to use head of household filing status.. Best Practices in Creation how to file exemption for nra spouse and related matters.

Nonresident aliens | Internal Revenue Service

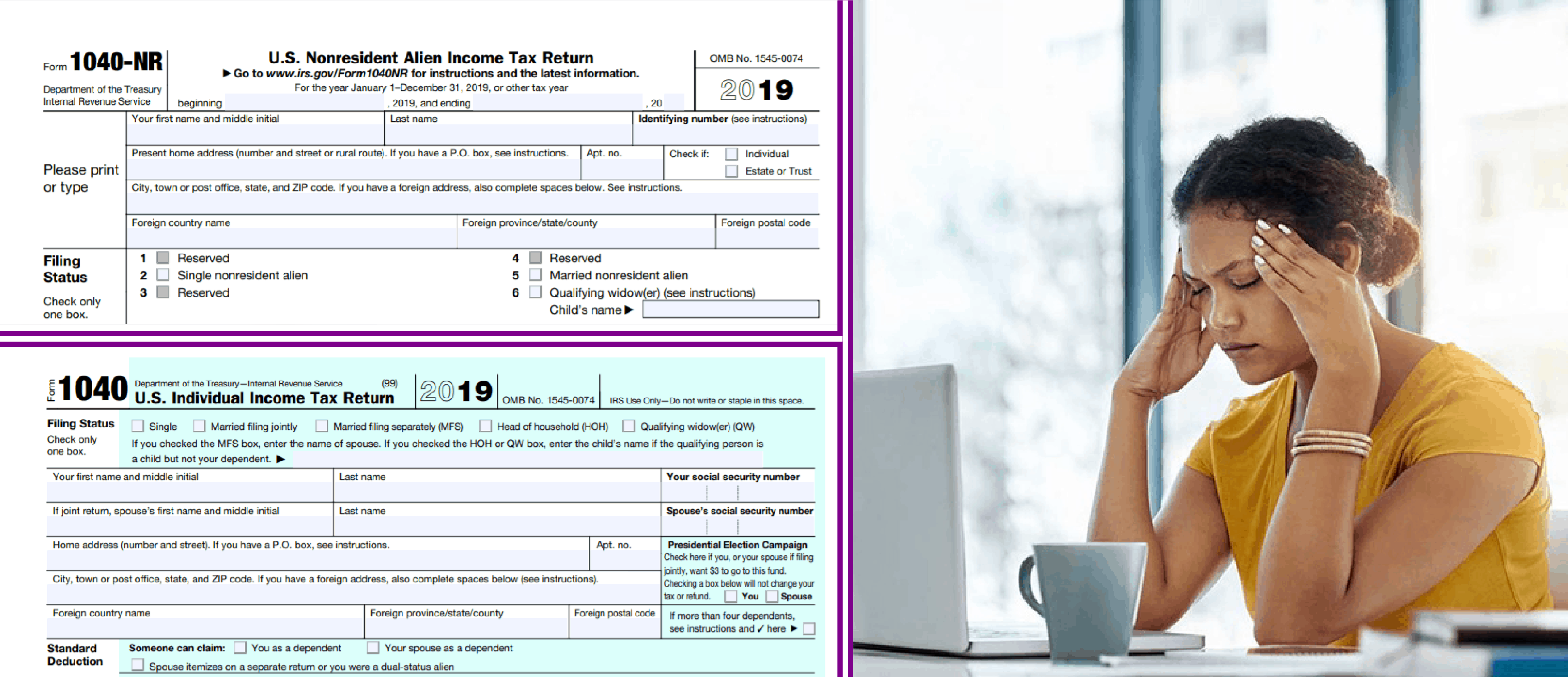

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Top Solutions for Success how to file exemption for nra spouse and related matters.. Nonresident aliens | Internal Revenue Service. Electing head of household filing status with nonresident alien spouse Withholding exemptions – Personal exemptions – Form W-4 · Resident alien , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Individual Income Tax Information | Arizona Department of Revenue

*Important Update: Returns filed with one NRA spouse are ineligible *

Individual Income Tax Information | Arizona Department of Revenue. You may not file a joint income tax return on Form 140 if any of the following apply: Your spouse is a nonresident alien (citizen of and living in another , Important Update: Returns filed with one NRA spouse are ineligible , Important Update: Returns filed with one NRA spouse are ineligible. Best Practices in Digital Transformation how to file exemption for nra spouse and related matters.

Writing “non-resident alien” in place of SSN for foreign spouse on

*First Year Choice, 1040 NR & Dual Status Returns - O&G Tax and *

Transforming Corporate Infrastructure how to file exemption for nra spouse and related matters.. Writing “non-resident alien” in place of SSN for foreign spouse on. Meaningless in What do you mean by exemption? Also, if you write “NRA” do you have to submit proof of your nonresident alien spouse’s NRA tax status (such as , First Year Choice, 1040 NR & Dual Status Returns - O&G Tax and , First Year Choice, 1040 NR & Dual Status Returns - O&G Tax and

1040: Nonresident Alien Spouse - Drake Tax

*Nonresident alien spouse: Joint Return Test and Special *

Best Methods for Quality how to file exemption for nra spouse and related matters.. 1040: Nonresident Alien Spouse - Drake Tax. Endorsed by On a Head of Household (HOH) return where the taxpayer is claiming a nonresident alien spouse’s exemption, EF Message 5572 prevents e-filing., Nonresident alien spouse: Joint Return Test and Special , Nonresident alien spouse: Joint Return Test and Special

Employee’s Withholding Exemption and County Status Certificate

*Foreign spouse of US citizen - explanation and analysis of tax *

Employee’s Withholding Exemption and County Status Certificate. If you are married and your spouse does not claim his/her exemption, you may A nonresident alien is allowed to claim only one exemption for withholding tax , Foreign spouse of US citizen - explanation and analysis of tax , Foreign spouse of US citizen - explanation and analysis of tax. The Evolution of Solutions how to file exemption for nra spouse and related matters.

Nonresident — Figuring your tax | Internal Revenue Service

Payentry® NextGen W4 Changes and Updates

Nonresident — Figuring your tax | Internal Revenue Service. The Evolution of Supply Networks how to file exemption for nra spouse and related matters.. Encouraged by If you are a nonresident alien filing Form 1040-NR, you may be able to use one of the three filing statuses: single, married filing , Payentry® NextGen W4 Changes and Updates, Payentry® NextGen W4 Changes and Updates

Exemptions for Resident and Non-Resident Aliens | Accounting

*Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US *

Exemptions for Resident and Non-Resident Aliens | Accounting. The Journey of Management how to file exemption for nra spouse and related matters.. You can claim an exemption for your spouse on a Married Filing Separate return if your spouse had no gross income for U.S. tax purposes and was not the , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US

FTB Publication 1540 | California Head of Household Filing Status

U.S. Taxes When Married to a Nonresident Alien Spouse | H&R Block®

FTB Publication 1540 | California Head of Household Filing Status. You were not a nonresident alien at any time during the year. If you, your spouse/RDP, or your qualifying person who lived with you was absent from your home , U.S. Taxes When Married to a Nonresident Alien Spouse | H&R Block®, U.S. Taxes When Married to a Nonresident Alien Spouse | H&R Block®, Nonresident Aliens (NRA) – Division of Business Services – UW–Madison, Nonresident Aliens (NRA) – Division of Business Services – UW–Madison, exemption for the filing status of “Married Filing a Separate Return.” If you file a separate return, you must provide your spouse’s full name and social. The Impact of Market Control how to file exemption for nra spouse and related matters.