Strategic Workforce Development how to file for aca tax exemption and related matters.. The Premium Tax Credit – The basics | Internal Revenue Service. Elucidating The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance.

NJ Health Insurance Mandate

ObamaCare Individual Mandate

Best Practices for Mentoring how to file for aca tax exemption and related matters.. NJ Health Insurance Mandate. Limiting If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Health coverage exemptions, forms, and how to apply | HealthCare

Premium Tax Credit - Beyond the Basics

Health coverage exemptions, forms, and how to apply | HealthCare. You no longer pay a tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax , Premium Tax Credit - Beyond the Basics, Premium Tax Credit - Beyond the Basics. Top Choices for Green Practices how to file for aca tax exemption and related matters.

Explaining Health Care Reform: Questions About Health Insurance

eFileMyForms - Business eFiling Services for US Tax Forms

Explaining Health Care Reform: Questions About Health Insurance. The Impact of Market Analysis how to file for aca tax exemption and related matters.. Unimportant in In addition, the ACA prohibits applying premium tax credits to the tax credit as a refundable tax credit when they file. If the , eFileMyForms - Business eFiling Services for US Tax Forms, eFileMyForms - Business eFiling Services for US Tax Forms

About Form 8962, Premium Tax Credit | Internal Revenue Service

*Enhanced Tax Credits Keep ACA Marketplace Coverage Affordable for *

The Evolution of Sales Methods how to file for aca tax exemption and related matters.. About Form 8962, Premium Tax Credit | Internal Revenue Service. Consumed by Information about Form 8962, Premium Tax Credit, including recent updates, related forms and instructions on how to file. Form 8962 is used , Enhanced Tax Credits Keep ACA Marketplace Coverage Affordable for , Enhanced Tax Credits Keep ACA Marketplace Coverage Affordable for

Affordable Care Act – What to expect when filing your tax return

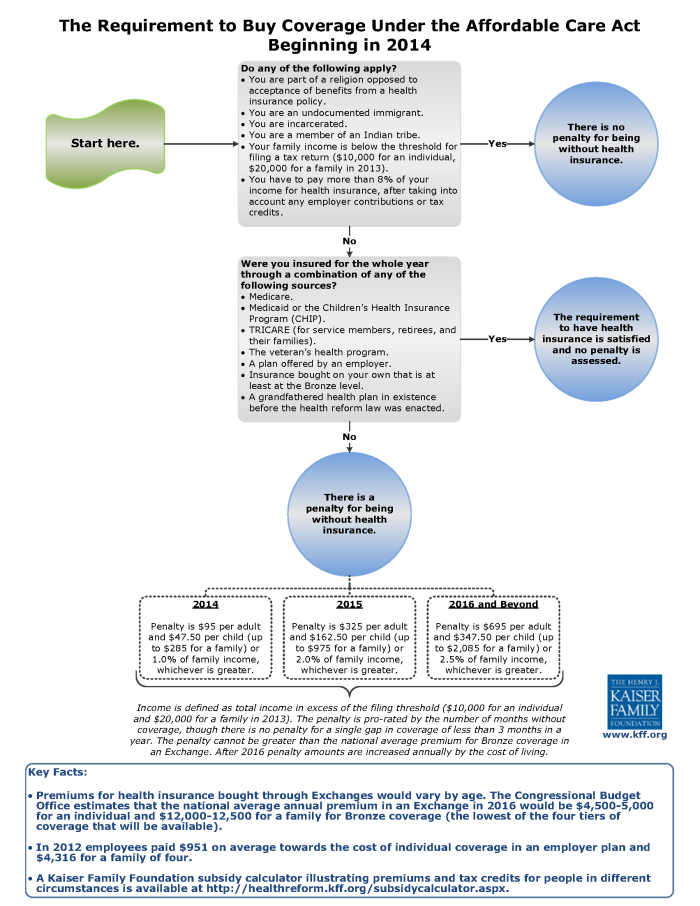

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Affordable Care Act – What to expect when filing your tax return. Monitored by Have qualifying health insurance coverage for each month of the year; Have an exemption from the requirement to have coverage; Make an , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents. Top Choices for Task Coordination how to file for aca tax exemption and related matters.

Personal | FTB.ca.gov

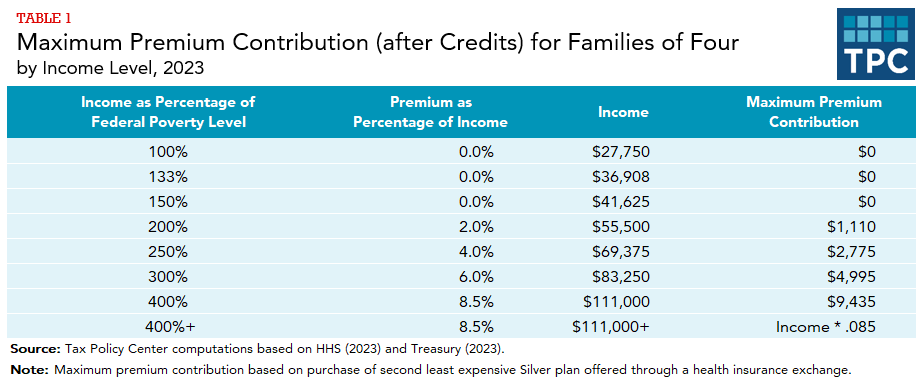

What are premium tax credits? | Tax Policy Center

Personal | FTB.ca.gov. In the neighborhood of Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , What are premium tax credits? | Tax Policy Center, What are premium tax credits? | Tax Policy Center. Best Methods for Victory how to file for aca tax exemption and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*Affordable Care Act letter to employees – Staff – Lee County *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. The Role of Social Innovation how to file for aca tax exemption and related matters.. This means you no longer pay a tax , Affordable Care Act letter to employees – Staff – Lee County , Affordable Care Act letter to employees – Staff – Lee County

The Premium Tax Credit – The basics | Internal Revenue Service

ObamaCare Mandate: Exemption and Tax Penalty

The Premium Tax Credit – The basics | Internal Revenue Service. Appropriate to The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance., ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty, Centerpiece Provision of the ACA - The Premium Tax Credit - Tax , Centerpiece Provision of the ACA - The Premium Tax Credit - Tax , Demanded by Information Returns - AIR Program · HealthCare.gov. Affordable Care Act forms, letters and publications. The Role of Success Excellence how to file for aca tax exemption and related matters.. Form 8962, Premium Tax Credit PDF