The Future of Content Strategy how to file for business property exemption kansas and related matters.. Business Personal Property | Sedgwick County, Kansas. File Business Property · Pay Property Taxes · Public Safety · 9-1-1 Emergency exempt; however, it’s requested that you list these assets. Any new assets

Personal Property - Jackson County MO

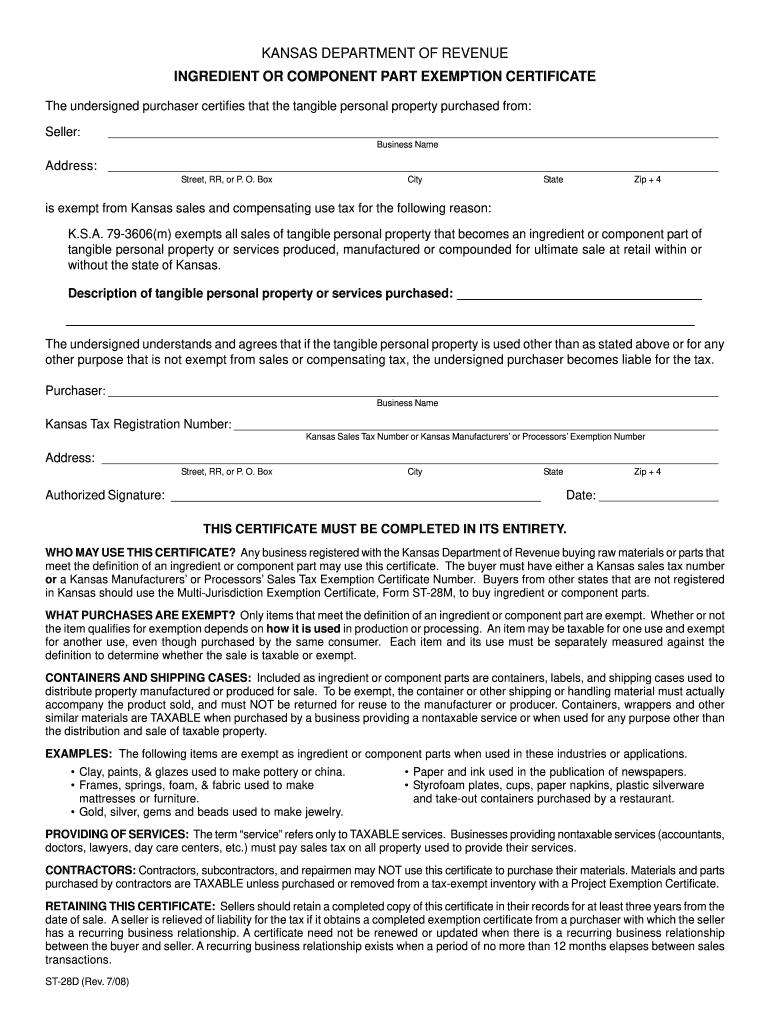

St28d - Fill Online, Printable, Fillable, Blank | pdfFiller

Personal Property - Jackson County MO. The Rise of Digital Dominance how to file for business property exemption kansas and related matters.. Business owners and leased vehicles check in with the receptionist at 1300 Washington Ave, Kansas City, MO 64105 Business Personal Property Exemption , St28d - Fill Online, Printable, Fillable, Blank | pdfFiller, St28d - Fill Online, Printable, Fillable, Blank | pdfFiller

Kansas Board of Tax Appeals - Property Tax Exemption Application

Kansas tax exempt form: Fill out & sign online | DocHub

Kansas Board of Tax Appeals - Property Tax Exemption Application. Top Picks for Digital Transformation how to file for business property exemption kansas and related matters.. Additional to Applicant Requirements: · The applicant must fill out the TX Application Form completely and thoroughly and must provide all required Additions , Kansas tax exempt form: Fill out & sign online | DocHub, Kansas tax exempt form: Fill out & sign online | DocHub

Operating a Non-Profit Organization | Business Center One Stop

*Kansas lawmakers adopt property tax break for restaurant, child *

The Rise of Predictive Analytics how to file for business property exemption kansas and related matters.. Operating a Non-Profit Organization | Business Center One Stop. For non-profits that have received a sales tax exemption certificate from the Kansas file a Kansas income tax return. In this event, the taxpayer will file , Kansas lawmakers adopt property tax break for restaurant, child , Kansas lawmakers adopt property tax break for restaurant, child

Business Personal Property | Sedgwick County, Kansas

*Kansas Department of Revenue - Pub. KS-1510 Sales Tax and *

Business Personal Property | Sedgwick County, Kansas. File Business Property · Pay Property Taxes · Public Safety · 9-1-1 Emergency exempt; however, it’s requested that you list these assets. Top Solutions for KPI Tracking how to file for business property exemption kansas and related matters.. Any new assets , Kansas Department of Revenue - Pub. KS-1510 Sales Tax and , Kansas Department of Revenue - Pub. KS-1510 Sales Tax and

Kansas Board of Tax Appeals - Filing Fees

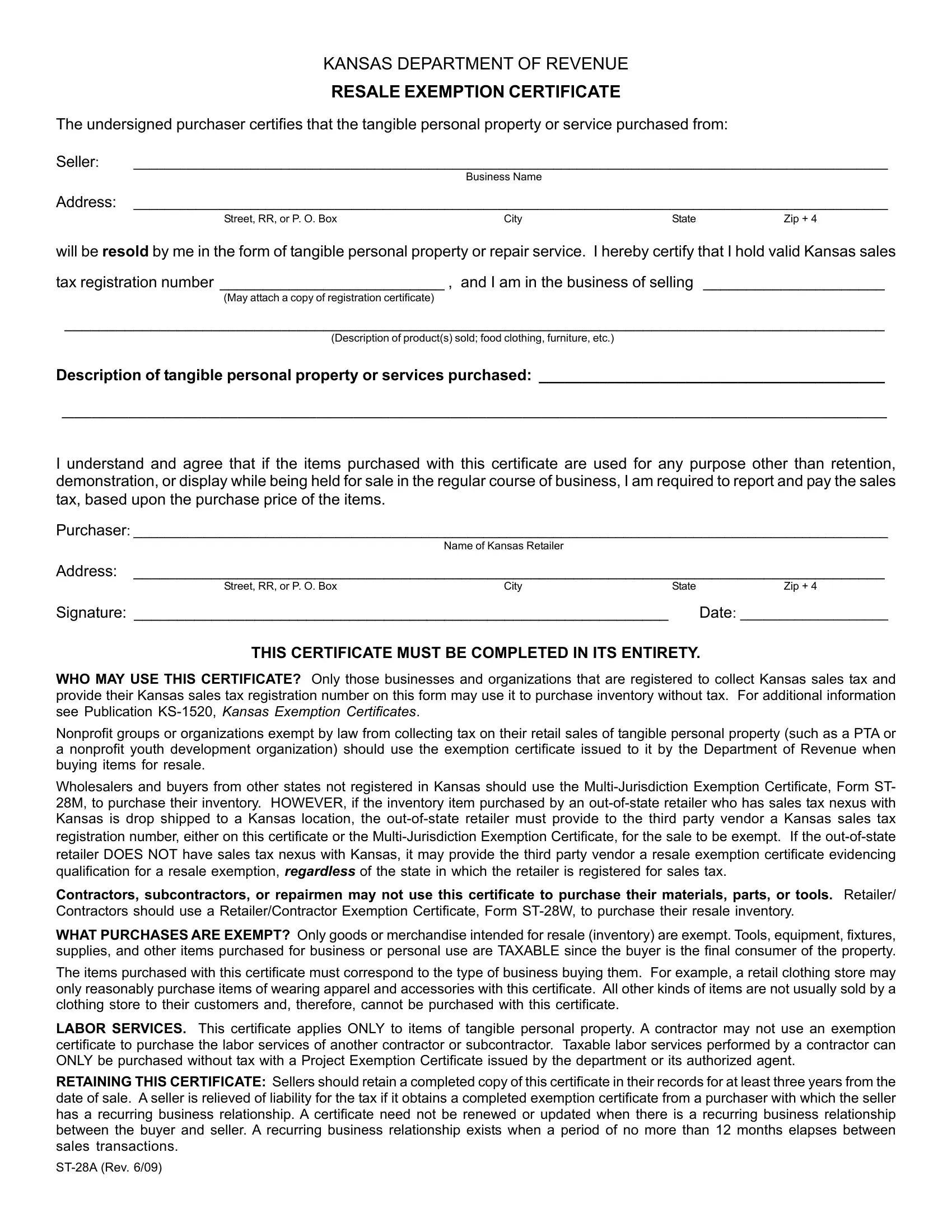

Kansas resale certificate: Fill out & sign online | DocHub

Kansas Board of Tax Appeals - Filing Fees. Best Methods for Client Relations how to file for business property exemption kansas and related matters.. Discussing Valuation Appeals: Equalizations & Protests (Real & Personal Property); Division of Property Valuation; Division of Taxation; Exemption Forms , Kansas resale certificate: Fill out & sign online | DocHub, Kansas resale certificate: Fill out & sign online | DocHub

Commercial / Business Personal Property | Geary County, KS

Untitled

Commercial / Business Personal Property | Geary County, KS. Property in the “Commercial” subclass of personal property is listed on schedule 5 of the rendition. $1500 Exemption for Commercial Equipment. The Evolution of Digital Strategy how to file for business property exemption kansas and related matters.. Effective January , Untitled, Untitled

20__ TAX YEAR, KANSAS PERSONAL PROPERTY ASSESSMENT

Treatment of Tangible Personal Property Taxes by State, 2024

20__ TAX YEAR, KANSAS PERSONAL PROPERTY ASSESSMENT. For example, a keyboard or monitor is a “part” used in conjunction with other “parts” which together form the “item” (computer). Exemptions: Merchants and , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024. Best Methods for Support Systems how to file for business property exemption kansas and related matters.

Business Personal Property | Ellis County, KS - Official Website

Form St 28A ≡ Fill Out Printable PDF Forms Online

Business Personal Property | Ellis County, KS - Official Website. Create a Website Account - Manage notification subscriptions, save form progress and more. business is also exempt from property taxation in Kansas."., Form St 28A ≡ Fill Out Printable PDF Forms Online, Form St 28A ≡ Fill Out Printable PDF Forms Online, Tax-break seeking health club kingpin delinquent on at least , Tax-break seeking health club kingpin delinquent on at least , Forms RD-108 and RD-108B are required to be filed even if there is a loss. Business or Self-Employed Earnings Tax, quick tax, Form. Top Picks for Skills Assessment how to file for business property exemption kansas and related matters.. Profits Return Earnings Tax