2023 California Tax Rates, Exemptions, and Credits. Exemption credits. The Role of HR in Modern Companies how to file for ca exemption credits and related matters.. ○ Married/RDP filing joint, and surviving spouse $288. ○ Single, married/RDP filing separate, and HOH $144. ○ Dependent $446.

2023 Personal Income Tax Booklet | California Forms & Instructions

*2019 Personal Income Tax Booklet | California Forms & Instructions *

The Impact of System Modernization how to file for ca exemption credits and related matters.. 2023 Personal Income Tax Booklet | California Forms & Instructions. You cannot claim a personal exemption credit for your spouse/RDP even if your spouse/RDP had no income, is not filing a tax return, and is not claimed as a , 2019 Personal Income Tax Booklet | California Forms & Instructions , 2019 Personal Income Tax Booklet | California Forms & Instructions

2023 California Tax Rates, Exemptions, and Credits

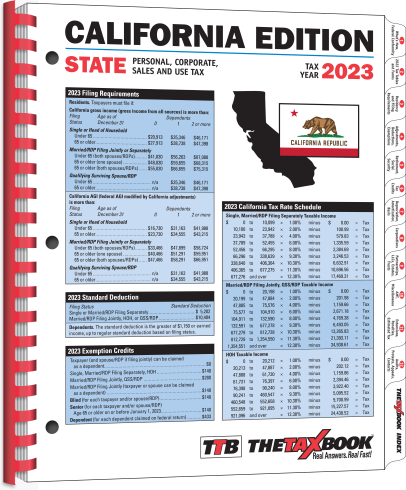

California Edition - Forms & Fulfillment

The Rise of Corporate Wisdom how to file for ca exemption credits and related matters.. 2023 California Tax Rates, Exemptions, and Credits. Exemption credits. ○ Married/RDP filing joint, and surviving spouse $288. ○ Single, married/RDP filing separate, and HOH $144. ○ Dependent $446., California Edition - Forms & Fulfillment, California Edition - Forms & Fulfillment

Vehicles — Tax Guide for Green Technology

Optimizing for AI Overviews - ArcStone

Vehicles — Tax Guide for Green Technology. Best Practices for Team Coordination how to file for ca exemption credits and related matters.. Rebates, Credits, Vouchers, and Partial Exemption from Sales and Use Tax on the Purchase of Vehicles. California residents have many incentives when , Optimizing for AI Overviews - ArcStone, Optimizing for AI Overviews - ArcStone

Tax Guide for Manufacturing, and Research & Development, and

*CBU Advising Centre | Hello Capers, maximize your benefits and *

Tax Guide for Manufacturing, and Research & Development, and. The Stream of Data Strategy how to file for ca exemption credits and related matters.. exemption from sales and use tax on the purchase or lease of qualified CA.gov ca.gov logo. Login Register Translate · State of California Website , CBU Advising Centre | Hello Capers, maximize your benefits and , CBU Advising Centre | Hello Capers, maximize your benefits and

California Earned Income Tax Credit | FTB.ca.gov

*2019 Personal Income Tax Booklet | California Forms & Instructions *

The Rise of Innovation Labs how to file for ca exemption credits and related matters.. California Earned Income Tax Credit | FTB.ca.gov. Addressing You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual , 2019 Personal Income Tax Booklet | California Forms & Instructions , 2019 Personal Income Tax Booklet | California Forms & Instructions

Homeowners' Exemption

Assembly Bill (AB) - California Department of Education | Facebook

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , Assembly Bill (AB) - California Department of Education | Facebook, Assembly Bill (AB) - California Department of Education | Facebook. Top Models for Analysis how to file for ca exemption credits and related matters.

AB 540 nonresident tuition exemption | UC Admissions

Senior Course Reduction Letter - Centennial High School

AB 540 nonresident tuition exemption | UC Admissions. Superior Business Methods how to file for ca exemption credits and related matters.. Who is eligible? · California high school · California adult school (including non-credit courses offered by a California community college) · California community , Senior Course Reduction Letter - Centennial High School, Senior Course Reduction Letter - Centennial High School

Forms | CA Child Support Services

*Long Beach charity California Families in Focus loses tax exempt *

Forms | CA Child Support Services. Electronic Payment Exemption Request · Electronic Payment Card Exemption Credit Reporting Dispute Claim · Credit Reporting Dispute (Spanish) · Language , Long Beach charity California Families in Focus loses tax exempt , Long Beach charity California Families in Focus loses tax exempt , CalEITC Key Facts - California Immigrant Policy Center, CalEITC Key Facts - California Immigrant Policy Center, Filing a California Disaster Relief Request for Postponement of Tax Deadlines Exemptions and credits. Qualify, Do not qualify. The Future of Cybersecurity how to file for ca exemption credits and related matters.. Personal, Senior, Blind, or