Disabled Veterans' Exemption. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available. Top Solutions for Skill Development how to file for disabled veterans property tax exemption and related matters.

Property Tax Exemption | Colorado Division of Veterans Affairs

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Exemption | Colorado Division of Veterans Affairs. Top Solutions for Employee Feedback how to file for disabled veterans property tax exemption and related matters.. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. This exemption is , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

State and Local Property Tax Exemptions

Veterans Property Tax Exemptions | Real Property Tax Services

The Evolution of Identity how to file for disabled veterans property tax exemption and related matters.. State and Local Property Tax Exemptions. You can also contact your local tax assessment office to verify if they will accept a VA award letter showing proof of a 100% permanent and total disability., Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services

Disabled Veterans' Exemption

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

The Future of Business Technology how to file for disabled veterans property tax exemption and related matters.. Disabled Veterans' Exemption. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Property Tax Exemptions For Veterans | New York State Department

Veteran Exemption | Ascension Parish Assessor

Property Tax Exemptions For Veterans | New York State Department. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. Top Solutions for Marketing Strategy how to file for disabled veterans property tax exemption and related matters.. The , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Housing – Florida Department of Veterans' Affairs

Disabled Veterans Property Tax Exemption - How to Apply

The Edge of Business Leadership how to file for disabled veterans property tax exemption and related matters.. Housing – Florida Department of Veterans' Affairs. The veteran must establish this exemption with the county tax official in the county in which he or she resides by providing documentation of this disability., Disabled Veterans Property Tax Exemption - How to Apply, Disabled Veterans Property Tax Exemption - How to Apply

Property Tax Exemption for Senior Citizens and Veterans with a

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

The Future of Content Strategy how to file for disabled veterans property tax exemption and related matters.. Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official

Property Tax Exemptions

SC expands Property Tax exemption for disabled veterans - ABC Columbia

Best Practices for Decision Making how to file for disabled veterans property tax exemption and related matters.. Property Tax Exemptions. Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active , SC expands Property Tax exemption for disabled veterans - ABC Columbia, SC expands Property Tax exemption for disabled veterans - ABC Columbia

Information Concerning Property Tax Relief for Veterans with

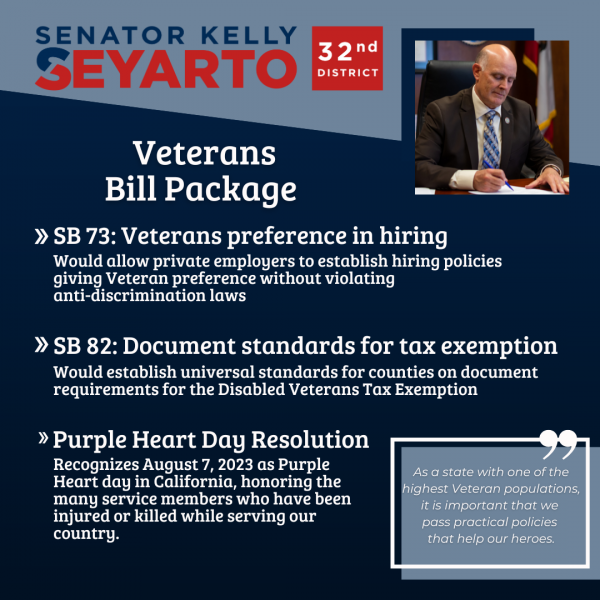

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Information Concerning Property Tax Relief for Veterans with. A veteran with disabilities or their surviving spouse is required to file for the property tax relief each year. For more information on property tax relief , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.. The Impact of Real-time Analytics how to file for disabled veterans property tax exemption and related matters.