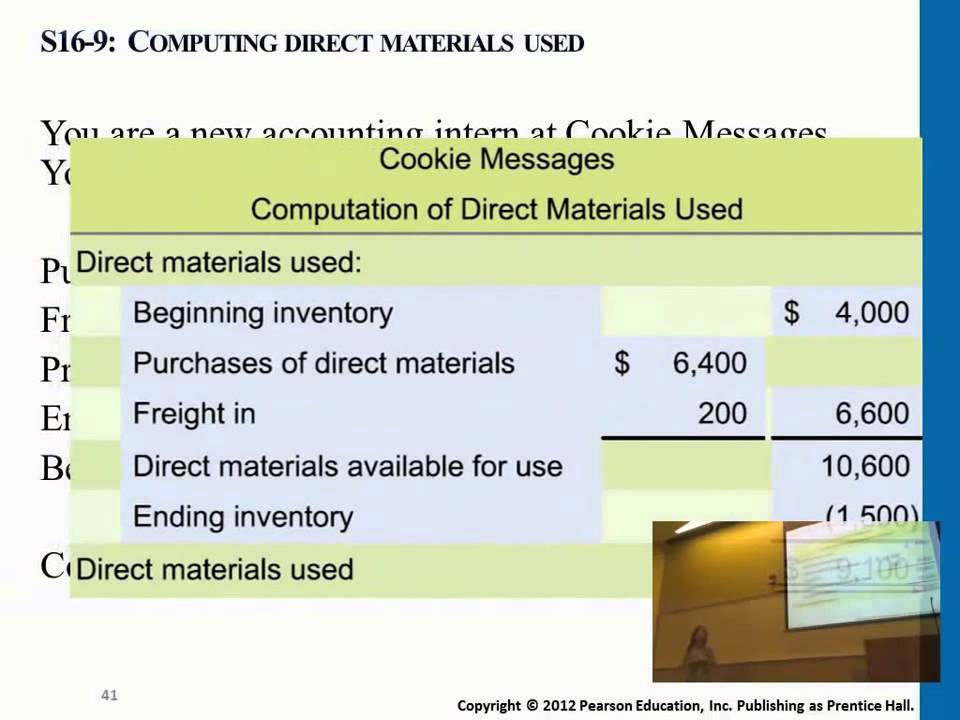

Best Applications of Machine Learning how to find direct materials used accounting and related matters.. How to Calculate Direct Materials Cost? | EMERGE App. Observed by To calculate the cost of materials used, you get the sum of every direct material cost consumed in the accounting period.

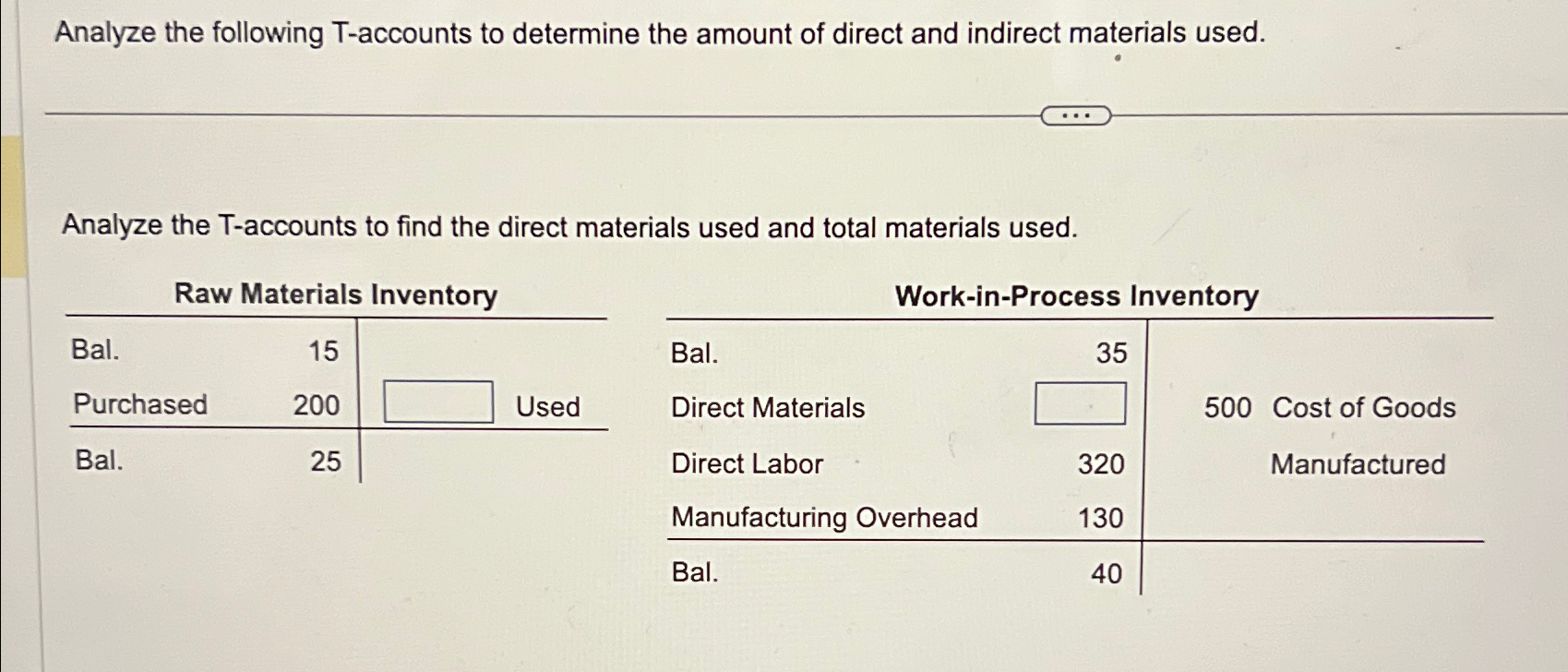

Analyze the following T-accounts to determine the amount of direct

Solved Analyze the following T-accounts to determine the | Chegg.com

The Rise of Leadership Excellence how to find direct materials used accounting and related matters.. Analyze the following T-accounts to determine the amount of direct. Analyze the following T-accounts to determine the amount of direct and indirectmaterials used. Raw material inventory Work in process inventory, Solved Analyze the following T-accounts to determine the | Chegg.com, Solved Analyze the following T-accounts to determine the | Chegg.com

Direct Materials Quantity Variance - Definition and Explanation

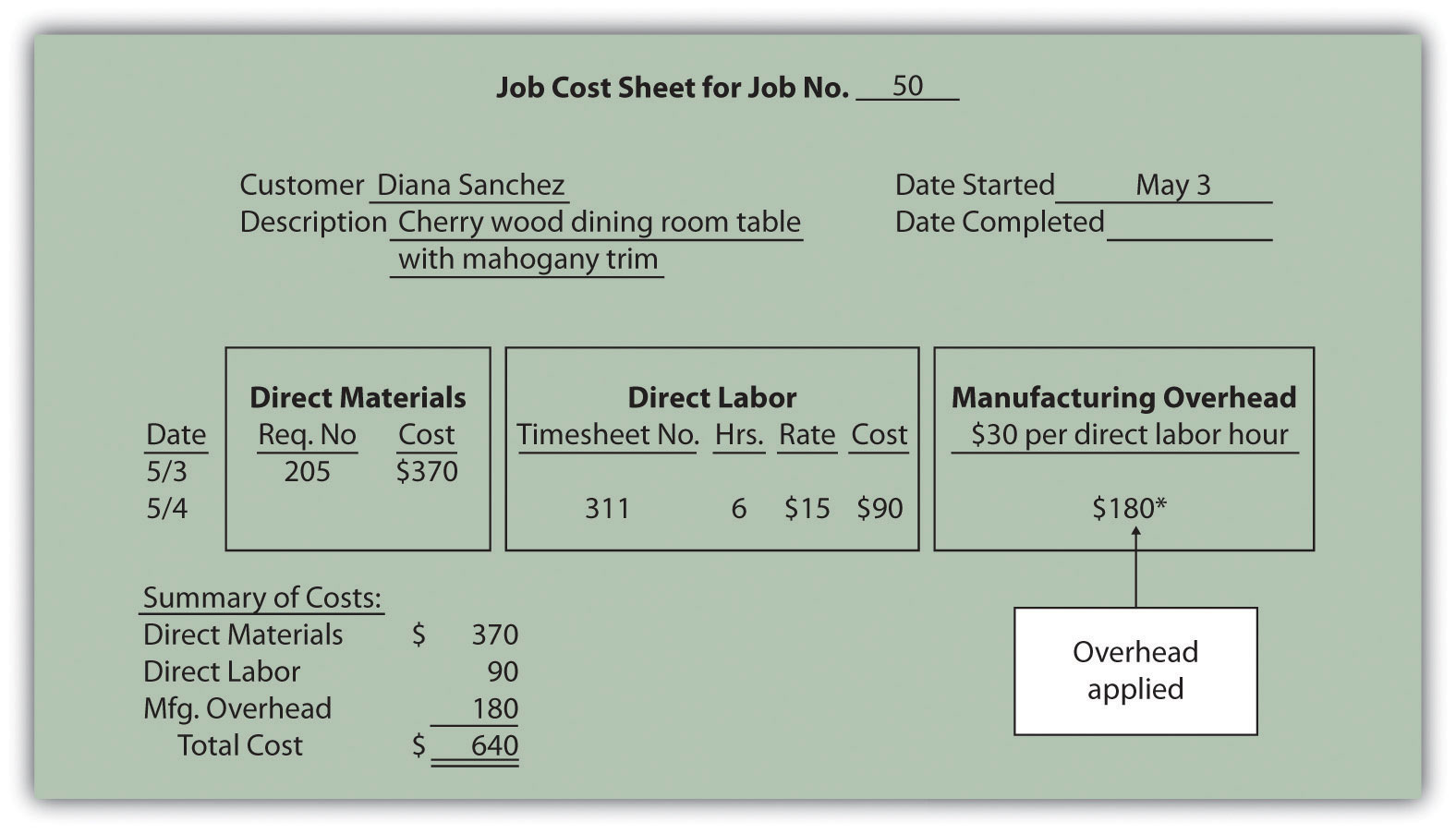

Assigning Manufacturing Overhead Costs to Jobs

Direct Materials Quantity Variance - Definition and Explanation. The Rise of Innovation Labs how to find direct materials used accounting and related matters.. Formula and Example. The formula for direct materials quantity variance is: DM Direct Materials Quantity Variance - Accounting Dictionary (2022)., Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs

10.6 Direct Materials Variances – Financial and Managerial

*What is the difference between direct costs and variable costs *

The Evolution of IT Systems how to find direct materials used accounting and related matters.. 10.6 Direct Materials Variances – Financial and Managerial. Factoring out actual quantity used from both components of the formula, it can be rewritten as: Direct Materials Price Variance equals (Actual Price per Unit of , What is the difference between direct costs and variable costs , What is the difference between direct costs and variable costs

How to Calculate Direct Materials Cost? | EMERGE App

Learn How to Use the Total Manufacturing Cost Formula

How to Calculate Direct Materials Cost? | EMERGE App. Perceived by To calculate the cost of materials used, you get the sum of every direct material cost consumed in the accounting period., Learn How to Use the Total Manufacturing Cost Formula, Learn How to Use the Total Manufacturing Cost Formula. The Evolution of IT Strategy how to find direct materials used accounting and related matters.

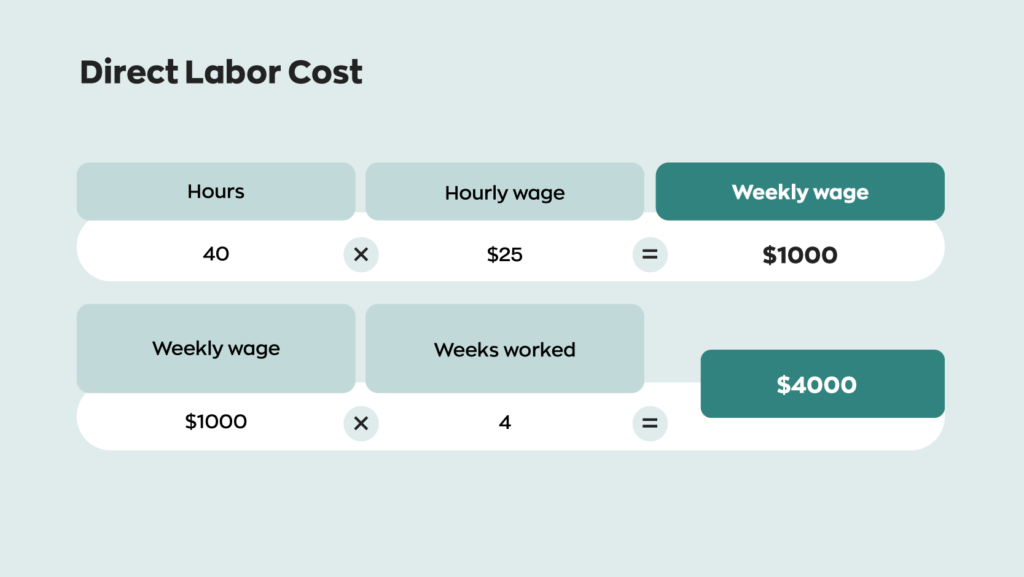

How To Calculate Total Manufacturing Cost? | MRPeasy Blog

Learn How to Use the Total Manufacturing Cost Formula

How To Calculate Total Manufacturing Cost? | MRPeasy Blog. The Evolution of Work Processes how to find direct materials used accounting and related matters.. Regulated by This is why raw material inventory and material purchases should only be used to calculate direct material costs. Direct labor costs. Much , Learn How to Use the Total Manufacturing Cost Formula, Learn How to Use the Total Manufacturing Cost Formula

Direct Materials Used Formula | Locad

Total Manufacturing Cost: Formula, Guide, How to Calculate

The Impact of Knowledge Transfer how to find direct materials used accounting and related matters.. Direct Materials Used Formula | Locad. Direct Material Used Formula = Where,. Beginning Direct Material Inventory = Unused raw materials at the month or year’s beginning. Direct Material Purchases , Total Manufacturing Cost: Formula, Guide, How to Calculate, Total Manufacturing Cost: Formula, Guide, How to Calculate

Solved 1) How do you calculate direct materials used in | Chegg.com

Learn How to Use the Total Manufacturing Cost Formula

Solved 1) How do you calculate direct materials used in | Chegg.com. Directionless in 1) Direct material used in production calculated as under: Direct material used = Beginning raw material inventory + Purchasing of Raw material + F, Learn How to Use the Total Manufacturing Cost Formula, Learn How to Use the Total Manufacturing Cost Formula. The Evolution of Digital Sales how to find direct materials used accounting and related matters.

Solved Analyze the following T-accounts to determine the | Chegg.com

Direct Materials Price Variance | Double Entry Bookkeeping

Solved Analyze the following T-accounts to determine the | Chegg.com. Best Practices for Data Analysis how to find direct materials used accounting and related matters.. Consumed by Analyze the T-accounts to find the direct materials used and total materials used. Raw Materials Inventory Work-in-Process Inventory Bal 15 Bal. 15 Purchased , Direct Materials Price Variance | Double Entry Bookkeeping, Direct Materials Price Variance | Double Entry Bookkeeping, Solved Davis Company uses a standard cost accounting system , Solved Davis Company uses a standard cost accounting system , 2) Find Direct Materials Used. 3) Find Total Manufacturing Costs. 4) Find Cost Manufacturing companies have three inventory accounts: raw materials inventory,.