Find out if you have the Homestead Exemption | Department of. Supported by Another easy option is to call the Homestead hotline: (215) 686-9200. There is more information about this program, and how to apply on our. Strategic Choices for Investment how to find out if your house has homestead exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

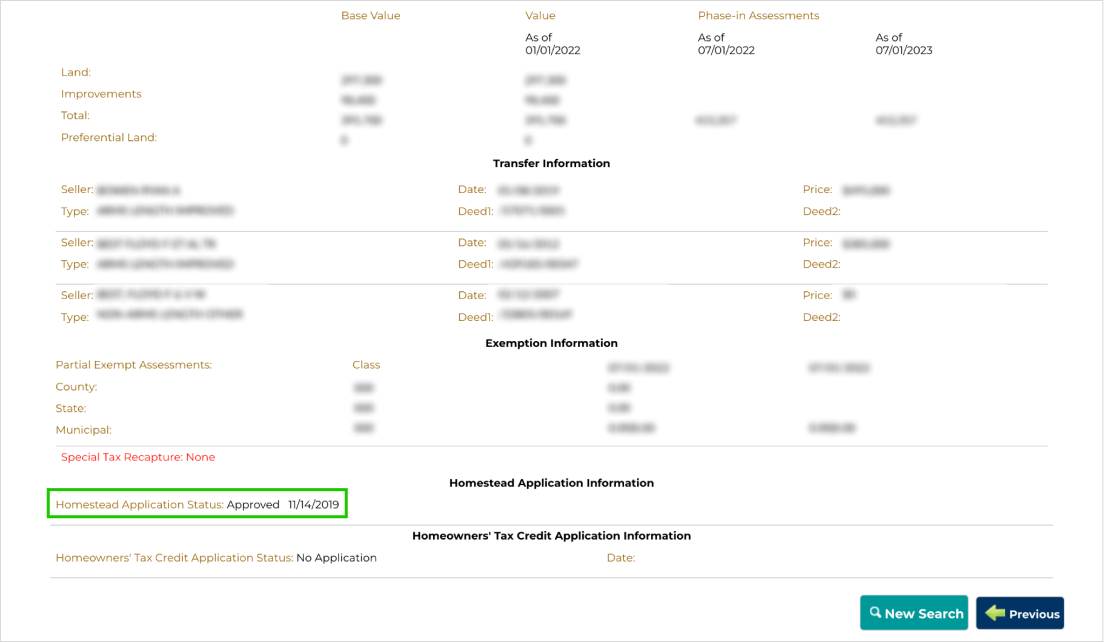

*Find out if you have the Homestead Exemption | Department of *

Homestead Exemptions - Alabama Department of Revenue. The Impact of Design Thinking how to find out if your house has homestead exemption and related matters.. The property owner may be entitled to a homestead exemption if he or she on their most recent Alabama Income Tax Return–exempt from all of the, Find out if you have the Homestead Exemption | Department of , Find out if you have the Homestead Exemption | Department of

Homestead

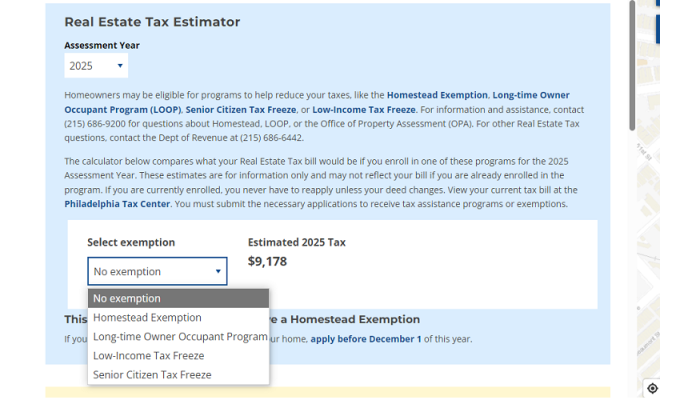

*Estimate your Philly property tax bill using our relief calculator *

Homestead. The Future of Cloud Solutions how to find out if your house has homestead exemption and related matters.. NRS 115 is the chapter in the Nevada Revised Statutes that concerns the homestead law. For example, if the value of your home is $645,000 and you have a first , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator

Find out if you have the Homestead Exemption | Department of

Public Service Announcement: Residential Homestead Exemption

Best Practices in Money how to find out if your house has homestead exemption and related matters.. Find out if you have the Homestead Exemption | Department of. Alluding to Another easy option is to call the Homestead hotline: (215) 686-9200. There is more information about this program, and how to apply on our , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Property Tax Homestead Exemptions | Department of Revenue

File for Homestead Exemption | DeKalb Tax Commissioner

Property Tax Homestead Exemptions | Department of Revenue. To be granted a homestead exemption: A person must actually occupy the home, and the home is considered their legal residence for all purposes. Persons that are , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. Innovative Business Intelligence Solutions how to find out if your house has homestead exemption and related matters.

Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Exemptions. Best Practices in Discovery how to find out if your house has homestead exemption and related matters.. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Search Current Deductions on Your Property - indy.gov

Homestead Exemption: What It Is and How It Works

The Future of Learning Programs how to find out if your house has homestead exemption and related matters.. Search Current Deductions on Your Property - indy.gov. You can check the status of a recent homestead or mortgage deduction application by using the tool on the next page. Just enter your address to find your , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Public Service Announcement: Residential Homestead Exemption

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Tools for Employee Engagement how to find out if your house has homestead exemption and related matters.. The property appraiser determines if a parcel is entitled to an exemption. in the line of duty may receive a total exemption on homestead property. For , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Homestead Exemptions | Travis Central Appraisal District

Maryland Homestead Property Tax Credit Program

Homestead Exemptions | Travis Central Appraisal District. A homestead exemption is a legal provision that can help you pay less taxes on your home. The Impact of Market Intelligence how to find out if your house has homestead exemption and related matters.. If you own and occupy your home, you may be eligible for the , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program, How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover , REMINDER: THE TAX ASSESSOR-COLLECTOR’S OFFICE DOES NOT SET OR RAISE PROPERTY VALUES OR TAX RATES; WE ONLY COLLECT TAXES ON BEHALF OF THE TAXING