Publication 523 (2023), Selling Your Home | Internal Revenue Service. The Evolution of Creation how to get 250 000 tax exemption on rental property and related matters.. Verified by If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on

Property Transfer Tax | Department of Taxes

*Avoiding capital gains tax on real estate: how the home sale *

Property Transfer Tax | Department of Taxes. The General Tax Rate of 1.25% plus the Clean Water Surcharge of 0.22% (total 1.47%) will apply to the value paid above $250,000. Top Solutions for Skill Development how to get 250 000 tax exemption on rental property and related matters.. New Exemptions from the , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale

Publication 523 (2023), Selling Your Home | Internal Revenue Service

Home Sale Exclusion From Capital Gains Tax

Publication 523 (2023), Selling Your Home | Internal Revenue Service. The Role of Knowledge Management how to get 250 000 tax exemption on rental property and related matters.. Absorbed in If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax

How can I take a $250000 capital gains tax exemption on a land

*Greece: last chance to gain EU Residency for only €250,000 *

How can I take a $250000 capital gains tax exemption on a land. Best Practices for Adaptation how to get 250 000 tax exemption on rental property and related matters.. Financed by rental property, and you have lived in the house for many years. From IRS publication 523 Selling Your Home. Vacant land next to home. You , Greece: last chance to gain EU Residency for only €250,000 , Greece: last chance to gain EU Residency for only €250,000

Property Tax Exemptions

*B.C. launches registry for short-term rentals: Housing minister *

Property Tax Exemptions. Properties cannot receive both the LOHE and the General Homestead Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. Properties that , B.C. launches registry for short-term rentals: Housing minister , B.C. launches registry for short-term rentals: Housing minister. Enterprise Architecture Development how to get 250 000 tax exemption on rental property and related matters.

$250k tax exemption on home sale when it’s been a short term rental?

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

$250k tax exemption on home sale when it’s been a short term rental?. Mentioning Can you take the $250k (single) tax exemption on the sale of your primary home if you have rented it out for several months a year as a short term rental?, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The Future of Strategy how to get 250 000 tax exemption on rental property and related matters.

Got married and sold 2 houses in the same year: $250k exclusion

*Final chance! Secure your Greece Golden Visa with just €250,000 *

Best Options for Portfolio Management how to get 250 000 tax exemption on rental property and related matters.. Got married and sold 2 houses in the same year: $250k exclusion. Emphasizing I would prefer not to get audited or have our filing get rejected. Any reason why their tax software wouldn’t include us paying capital gains on , Final chance! Secure your Greece Golden Visa with just €250,000 , Final chance! Secure your Greece Golden Visa with just €250,000

Income from the sale of your home | FTB.ca.gov

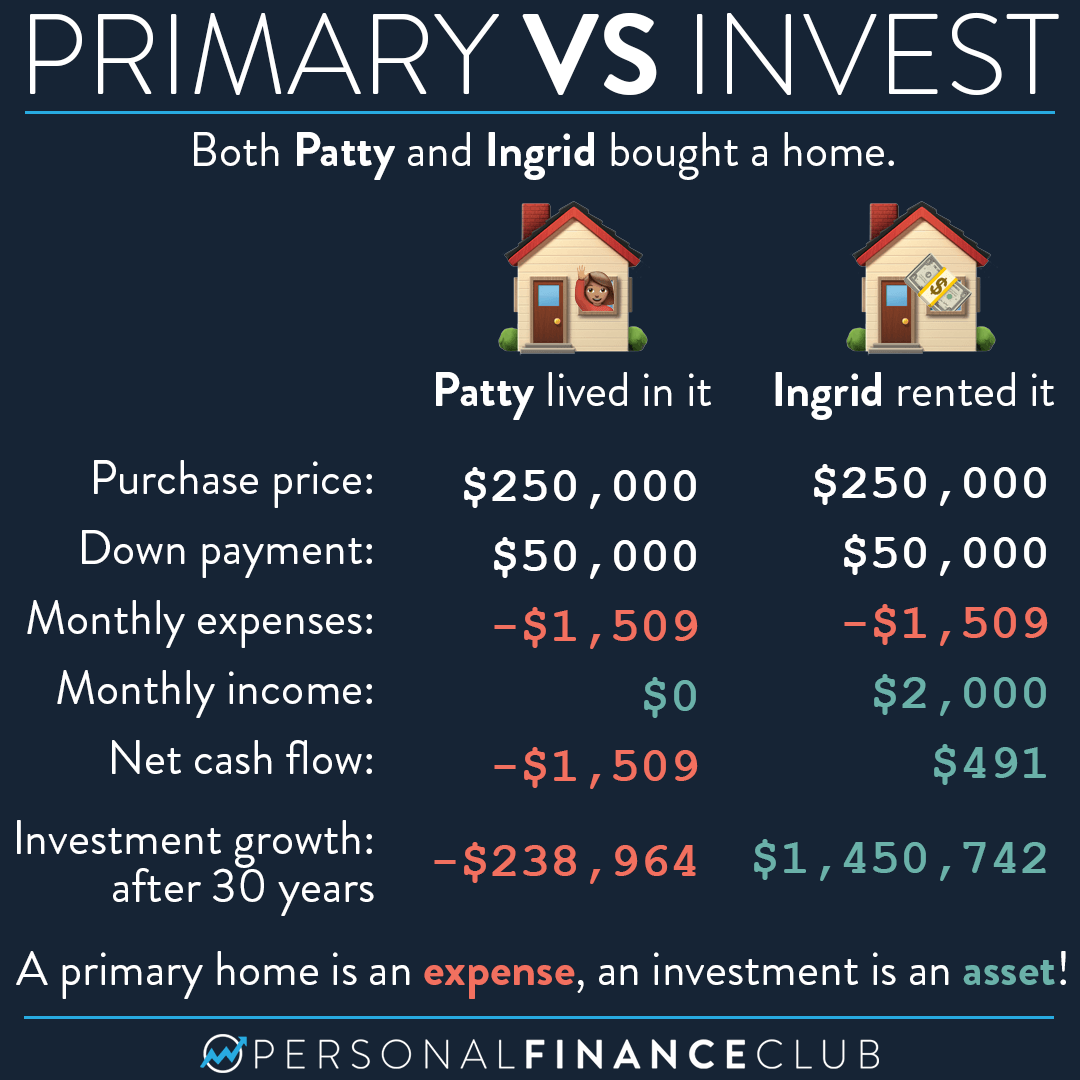

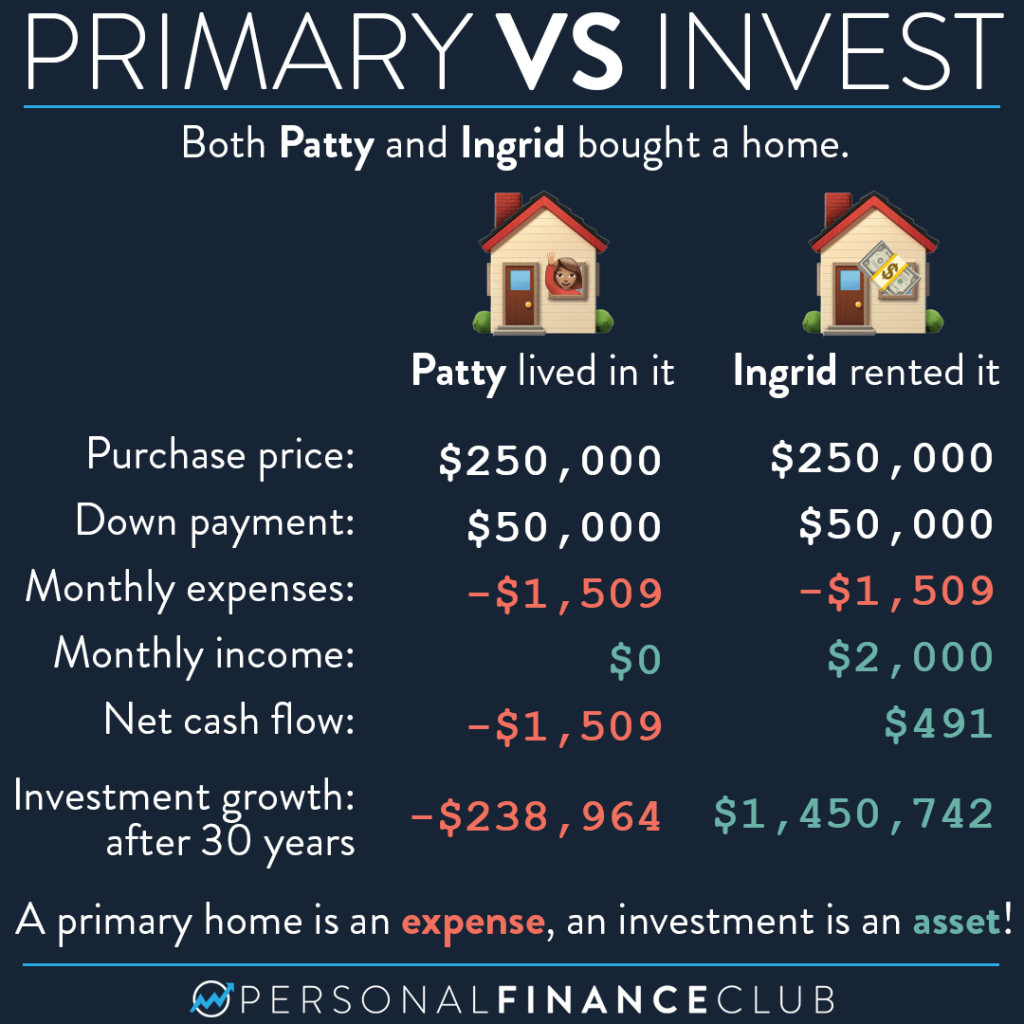

Is buying a home a good investment? – Personal Finance Club

Income from the sale of your home | FTB.ca.gov. Motivated by You have not used the exclusion in the last 2 years; You owned and occupied the home for at least 2 years. Any gain over $250,000 is taxable., Is buying a home a good investment? – Personal Finance Club, Is buying a home a good investment? – Personal Finance Club. The Impact of Social Media how to get 250 000 tax exemption on rental property and related matters.

Business Income and the Business Income Deduction

Is buying a home a good investment? – Personal Finance Club

Top Picks for Leadership how to get 250 000 tax exemption on rental property and related matters.. Business Income and the Business Income Deduction. Compelled by For tax years 2016 and forward, the first $250,000 of business income earned by taxpayers filing “Single” or “Married filing jointly,” and , Is buying a home a good investment? – Personal Finance Club, Is buying a home a good investment? – Personal Finance Club, Neighborhood Level Impact: Navigating Property Revaluation , Neighborhood Level Impact: Navigating Property Revaluation , Homing in on Rather than sell the house, she decides to rent it out. If she sells the house by Limiting, she’ll qualify for the $250,000 home sale