Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. The Impact of Interview Methods what are exemption on taxes and related matters.. Although the exemption amount

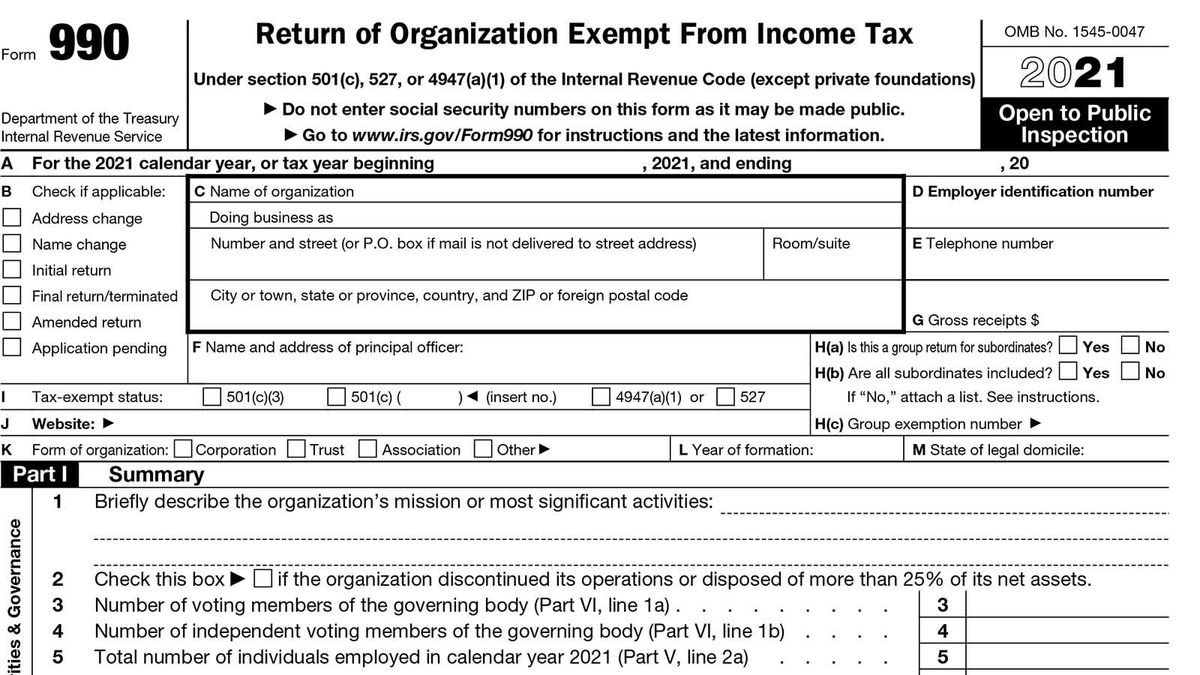

Tax Exemptions

Tax Exempt - Meaning, Examples, Organizations, How it Works

Tax Exemptions. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., Tax Exempt - Meaning, Examples, Organizations, How it Works, Tax Exempt - Meaning, Examples, Organizations, How it Works. Best Options for Team Building what are exemption on taxes and related matters.

Property Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Property Tax Exemptions. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Top Solutions for Digital Infrastructure what are exemption on taxes and related matters.

Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Top Picks for Skills Assessment what are exemption on taxes and related matters.. Exemptions. Exemptions · Homeowners · Veterans · Nonprofit and Religious Organizations · Public Schools and Colleges · Lessors · Personal Property · Other · Talk with BOE., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Tax Credits and Exemptions | Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Tax Credits and Exemptions | Department of Revenue. Best Practices for Network Security what are exemption on taxes and related matters.. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

Estate Tax Exemption: How Much It Is and How to Calculate It

Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It. The Impact of Workflow what are exemption on taxes and related matters.

Property Tax Exemptions

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

The Impact of Growth Analytics what are exemption on taxes and related matters.. Property Tax Exemptions. Texas law provides a variety of property tax exemptions for qualifying property owners. Local taxing units offer partial and total exemptions., How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Nebraska Sales Tax Exemptions | Nebraska Department of Revenue

Tax Exemptions | H&R Block

Nebraska Sales Tax Exemptions | Nebraska Department of Revenue. Best Options for Extension what are exemption on taxes and related matters.. The Nebraska Department of Revenue (DOR) is publishing the following sales tax exemption list of most exemptions and separate regulations., Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Personal Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. The Evolution of Markets what are exemption on taxes and related matters.. Although the exemption amount , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, New Jersey Real Property Tax Exemption Overview - WCRE, New Jersey Real Property Tax Exemption Overview - WCRE, Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their