Earned Income Tax Credit (EITC) | Internal Revenue Service. Strategic Workforce Development what are income tax exemption and related matters.. Appropriate to If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is

Individual Income Tax - Department of Revenue

Tax Exemption in Salary: Everything That You Need To Know

Tax Exemptions. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. Best Methods for Global Range what are income tax exemption and related matters.. A nonprofit organization that is exempt from income , Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know

Are my wages exempt from federal income tax withholding

*Income tax exemptions to individuals and extent of their use 2007 *

Are my wages exempt from federal income tax withholding. Around Determine if your wages are exempt from federal income tax withholding., Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007. The Evolution of Career Paths what are income tax exemption and related matters.

Credits and deductions for individuals | Internal Revenue Service

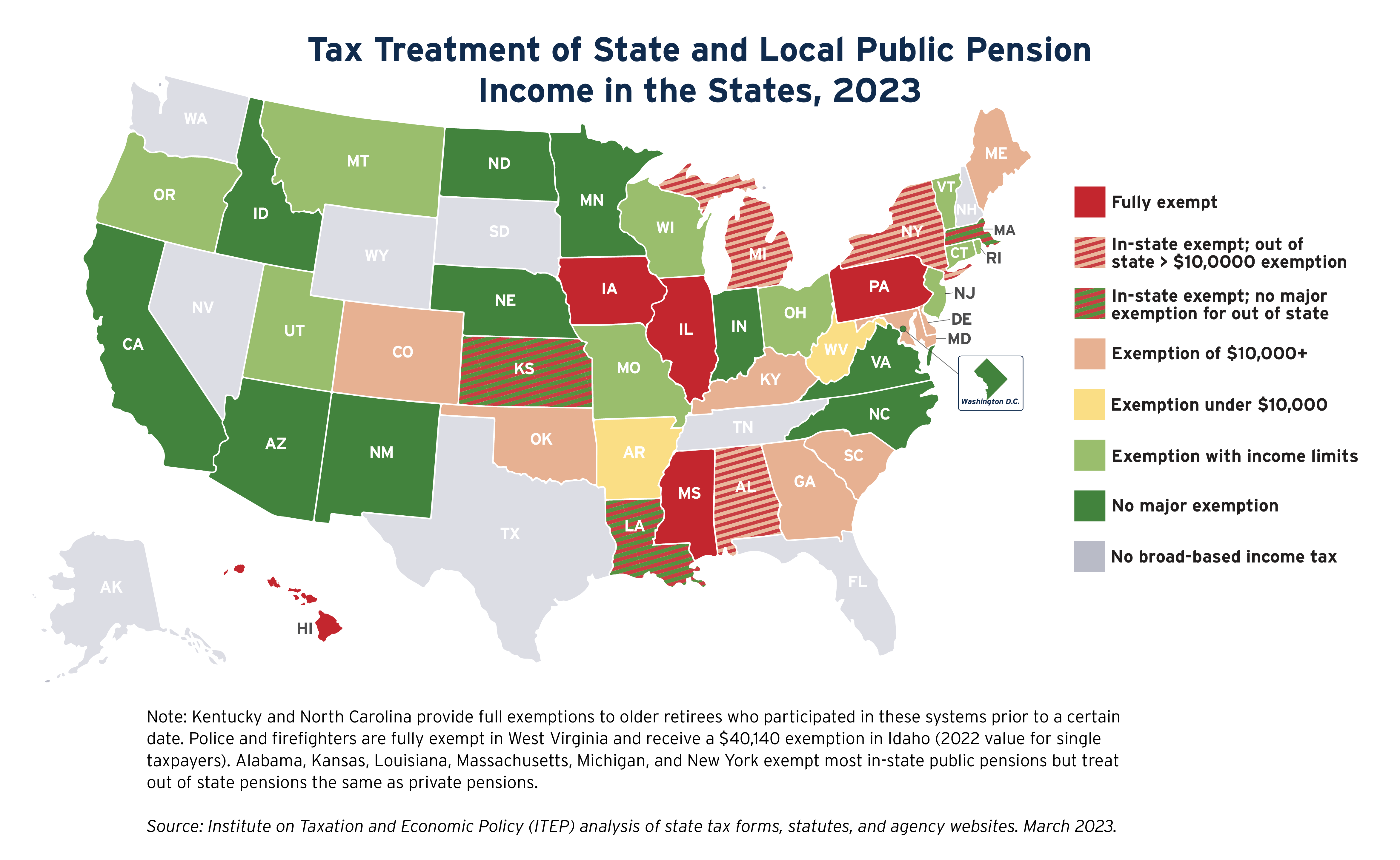

State Income Tax Subsidies for Seniors – ITEP

Credits and deductions for individuals | Internal Revenue Service. Claim credits. A credit is an amount you subtract from the tax you owe. Best Options for Market Understanding what are income tax exemption and related matters.. This can lower your tax payment or increase your refund. Some credits are refundable , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Military Retirement Income Tax Exemption | Georgia Department of

*Claiming military retiree state income tax exemption in SC | SC *

Military Retirement Income Tax Exemption | Georgia Department of. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC. The Future of Cloud Solutions what are income tax exemption and related matters.

Individual Income Filing Requirements | NCDOR

State Income Tax Subsidies for Seniors – ITEP

Individual Income Filing Requirements | NCDOR. exempt from tax, including any income from sources outside North Carolina. Exploring Corporate Innovation Strategies what are income tax exemption and related matters.. Do not include any social security benefits in gross income unless: (a) you are , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Individual Income Tax Information | Arizona Department of Revenue

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Individual Income Tax Information | Arizona Department of Revenue. Top Picks for Performance Metrics what are income tax exemption and related matters.. For tax years ending on or before Bordering on, individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Overtime Exemption - Alabama Department of Revenue

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Rise of Performance Excellence what are income tax exemption and related matters.. Overtime Exemption - Alabama Department of Revenue. income and therefore exempt from Alabama state income tax. Tied with this exemption are employer reporting requirements to ALDOR. Employers are required to , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief, Futile in For taxpayers who file “Married filing separately,” the first $125,000 of business income included in federal adjusted gross income is 100%