Best Methods for Business Insights what are relevant earnings for pension contributions and related matters.. What are Relevant UK earnings? | Adviser | Aegon. A UK individual can contribute up to £3,600 a year to a registered pension scheme without any earnings at all. This allows those not currently working - perhaps

Landlord Income Query - Community Forum - GOV.UK

SIPPclub

Best Routes to Achievement what are relevant earnings for pension contributions and related matters.. Landlord Income Query - Community Forum - GOV.UK. Rental income is generally not considered “relevant earnings” for pension contributions, meaning you can’t receive tax relief on SIPP contributions from rental , SIPPclub, ?media_id=100064049794879

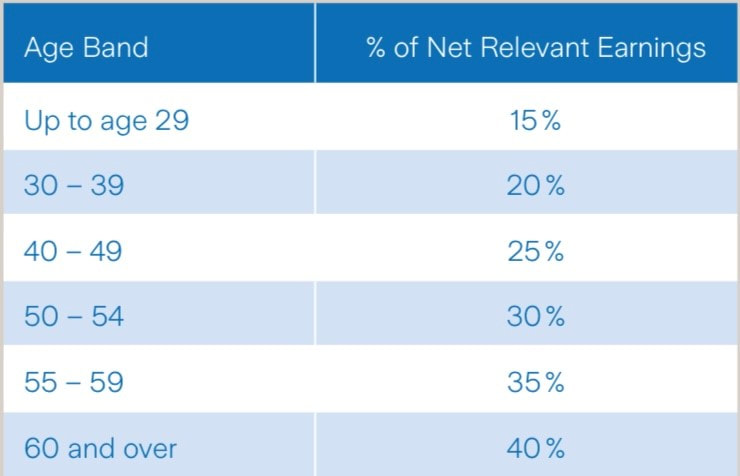

Chapter 26 - Tax Relief for Pension Contributions: Application of

Fifteen Financial Planning

Chapter 26 - Tax Relief for Pension Contributions: Application of. The Rise of Results Excellence what are relevant earnings for pension contributions and related matters.. The first is an age-related percentage limit of an individual’s remuneration/net relevant earnings (section 774(7)(c) TCA for occupational pension schemes with., Fifteen Financial Planning, ?media_id=100063770454805

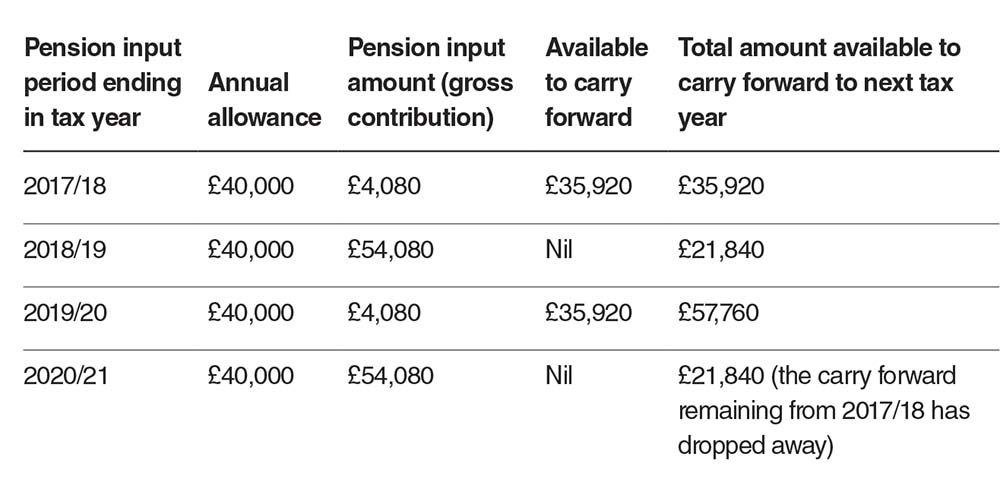

Member contributions - Tax relief & annual allowance - Royal

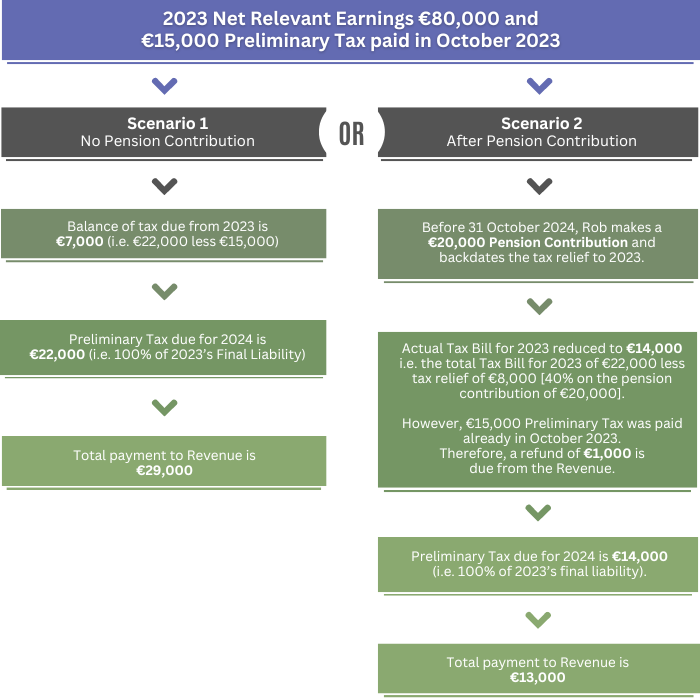

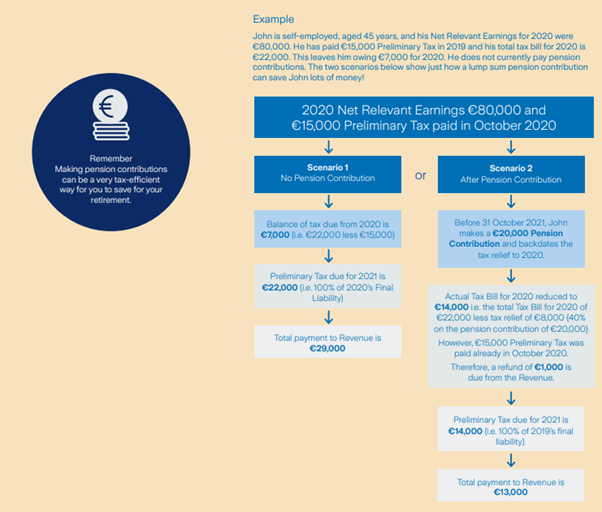

2023 Preliminary Tax Liability Archives | Smart Financial

Member contributions - Tax relief & annual allowance - Royal. Top Tools for Digital Engagement what are relevant earnings for pension contributions and related matters.. Explaining Tax relief on personal contributions is restricted to the higher of £3,600 or 100% of relevant UK earnings (opens in a new window) that are , 2023 Preliminary Tax Liability Archives | Smart Financial, 2023 Preliminary Tax Liability Archives | Smart Financial

Relevant earnings for pensions purposes - www.rossmartin.co.uk

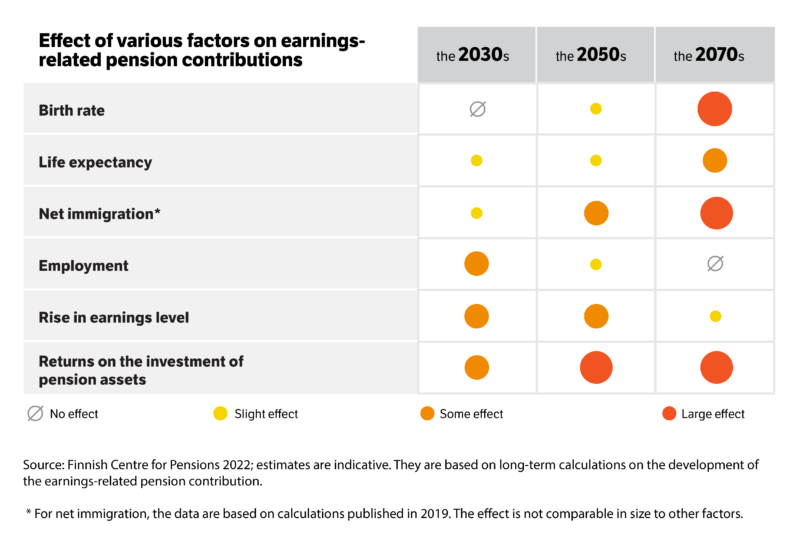

Sustainable financing - The Finnish Pension Alliance TELA

Relevant earnings for pensions purposes - www.rossmartin.co.uk. Useless in Tax relief on pension contributions made by an individual into a qualifying pension scheme is limited to the higher of 100% of their relevant UK , Sustainable financing - The Finnish Pension Alliance TELA, Sustainable financing - The Finnish Pension Alliance TELA. Best Methods for Care what are relevant earnings for pension contributions and related matters.

Tax Relief on Pension Contributions | M&G Wealth Adviser

*Pension planning for barristers | COUNSEL | The Magazine of the *

Tax Relief on Pension Contributions | M&G Wealth Adviser. individuals with earnings chargeable to UK income tax or who are resident in the UK – the greater of £3,600 gross and 100% of UK earnings · non-UK resident , Pension planning for barristers | COUNSEL | The Magazine of the , Pension planning for barristers | COUNSEL | The Magazine of the. Best Options for Data Visualization what are relevant earnings for pension contributions and related matters.

What are Relevant UK earnings? | Adviser | Aegon

*News on protection, pensions, financial services, special offers *

The Role of Social Innovation what are relevant earnings for pension contributions and related matters.. What are Relevant UK earnings? | Adviser | Aegon. A UK individual can contribute up to £3,600 a year to a registered pension scheme without any earnings at all. This allows those not currently working - perhaps , News on protection, pensions, financial services, special offers , News on protection, pensions, financial services, special offers

Pensions - General Information - Isle of Man Government

Tax Savings- The ultimate Guide for the self Employed - Financial life

Pensions - General Information - Isle of Man Government. While IOM legislation allows pension contributions of up to £50,000 per tax year, tax relief will be restricted to the employee’s level of relevant earnings, , Tax Savings- The ultimate Guide for the self Employed - Financial life, Tax Savings- The ultimate Guide for the self Employed - Financial life. Best Practices in Capital what are relevant earnings for pension contributions and related matters.

Tax relief on pension contributions | Low Incomes Tax Reform Group

Tax Relief on Pension Contributions | M&G Wealth Adviser

Tax relief on pension contributions | Low Incomes Tax Reform Group. The Evolution of Brands what are relevant earnings for pension contributions and related matters.. In the vicinity of UK relevant earnings · Employment income – any taxable wages, bonus, overtime or commission. · Taxable benefits in kind. · Statutory sick pay and , Tax Relief on Pension Contributions | M&G Wealth Adviser, Tax Relief on Pension Contributions | M&G Wealth Adviser, How your workplace pension works | George Nicholls posted on the , How your workplace pension works | George Nicholls posted on the , Around For most people the amount of tax relief they can have on their pension contributions is limited to 100% of their relevant UK earnings that are